“I think you have to learn that there’s a company behind every stock and

there’s only one real reason why stocks go up. Companies go from doing poorly to doing well or small companies grow to large companies.”

– Peter Lynch

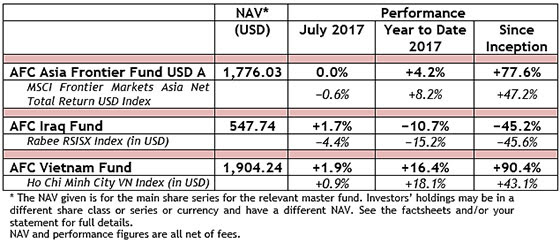

AFC Funds Performance Summary

Most major equity markets in the world performed well this past month, adding to their returns of the first half of this year, and several are showing double digit returns year-to-date. The Nikkei 225 Index bucked the trend and lost −0.5%. The MSCI World Index added +2.4% while the S&P 500 Index was up +1.9%. The MSCI Emerging Markets Index rallied +6.0% showing a return of +25.5% YTD while the MSCI Frontier Markets Net Total Return USD Index added +2.1%. The MSCI Frontier Markets Asia Net Total Return USD Index was down −0.6%, confirming the low correlation between the different frontier markets, and between frontier markets and the major developed world markets. Outperforming this index, the AFC Asia Frontier Fund remained flat in July as the political noise in Pakistan reached a peak. The fund is now up +77.6% since inception, which corresponds to a healthy annualized return of +11.4% p.a.

The AFC Iraq Fund returned +1.7% in July and its performance year-to-date is −10.7%.

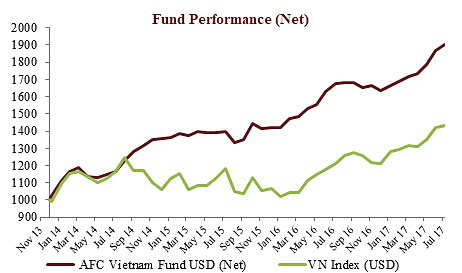

The AFC Vietnam Fund rose +1.9% in July, outperforming the VN-Index in USD terms which rose +0.9%. The fund is now up +16.4% YTD and +90.4% since inception, which corresponds to an annualized return of +19.6% p.a.

Significant Fund Inflow

The AFC Vietnam Fund enjoyed a strong net fund inflow this month adding USD3.5 mln during July 2017, the strongest net inflow in a single month so far, which lifted the fund’s AUM to USD 43.3 mln as of 1st August 2017.

Launch of an AFC Asia Frontier “Parallel Fund” in Luxembourg

In order to provide better and easier access for our European investors, Asia Frontier Capital is in the process of establishing a “Parallel Fund” of the AFC Asia Frontier Fund in Luxembourg. The launch of AFC Asia Frontier Fund (Lux) is imminent and will be announced later this quarter.

The Luxembourg-based fund will invest up to 84% in the existing Cayman Islands-based AFC Asia Frontier Fund and the balance will be invested directly in stocks that the Cayman Islands fund is also holding. We expect that the performance of the Luxembourg based fund will be very similar to the existing Cayman Islands-based fund.

Change of minimum investment amount for subsequent investments in the AFC Asia Frontier Fund reduced

For the convenience of investors in the AFC Asia Frontier Fund, we have amended the fund terms to allow investors to add to their existing investments with amounts as low as US$5,000, CHF5,000 or EUR5,000. The minimum initial investment amount remains at US$25,000, CHF25,000 or EUR25,000 for non-US investors, and US$50,000, CHF50,000 or EUR50,000 for US investors.

Having seen significant fund inflows this month and launching a parallel fund in Luxembourg while also reducing the additional minimum investment amounts, our funds have become even easier to access for investors. This is a significant advantage compared with the difficulties someone would face gaining access to Asian frontier markets directly. Frontier markets provide a great diversification opportunity with a low correlation to developed markets, combined with sustainable long-term returns. At a time when developed markets are getting into expensive territory, we expect the appetite from investors for frontier markets to continue to increase, especially in Asia given the growth dynamics and favourable demographics in the region. Our funds are a very attractive option to benefit from the strong growth in Asian frontier markets, while also providing a diversification opportunity.

If you have any questions about our funds or would like any additional information, please be in touch with our team at info@asiafrontiercapital.com.

AFC in the Press

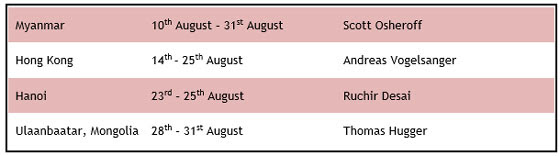

Upcoming AFC Travel

If you have an interest in meeting with our team during their travels, please contact Peter de Vries at pdv@asiafrontiercapital.com.

AFC Asia Frontier Fund – Manager Comment July 2017

AFC Asia Frontier Fund (AAFF) USD A-shares were flat in July 2017. The fund outperformed the MSCI Frontier Markets Asia Net Total Return USD Index (−0.6%) but underperformed the MSCI Frontier Markets Net Total Return USD Index (+2.1%) and the MSCI World Net Total Return USD Index, which was up +2.4%. The performance of the AFC Asia Frontier Fund A-shares since inception on 31st March 2012 now stands at +77.6% versus the MSCI Frontier Markets Asia Net Total Return USD Index, which is up +47.2%, and the MSCI Frontier Markets Net Total Return USD Index (+43.8%) during the same time period. The fund’s annualized performance since inception is +11.4% p.a., while its YTD performance stands at +4.2%. The broad diversification of the fund’s portfolio has resulted in lower risk, with an annualised volatility of 8.85%, a Sharpe ratio of 1.26, and a correlation of the fund versus the MSCI World Net Total Return USD Index of 0.33 all based on monthly observations since inception.

The political uncertainty in Pakistan continued to hang over the market for the most part in July. Fortunately, a large part of this political uncertainty was put to rest on 28th July when the Prime Minister, Nawaz Sharif, was disqualified by the Supreme Court from holding public office. So far, the market has taken this in its stride, with the KSE 100 remaining flat since 28th July as over the past few weeks it became more apparent that the Prime Minister would be disqualified and this was therefore being priced in when the decision by the Supreme Court came in.

More importantly, the current government led by the Pakistan Muslim League (N) or the PML (N) will continue to run affairs until the caretaker government comes in before the national elections in June, 2018. Also important to note, the Prime Minister’s position will most probably be held in the interim by Shehbaz Sharif, the Chief Minister of the Punjab province and the younger brother of Nawaz Sharif. Additionally, these events went off without either any major disruption to business activities or any kind of large scale protests which should be seen as a positive.

Politically, one could argue that the Supreme Court judgement is a blow for the PML (N). The main opposition, the Pakistan Tehreek-e-Insaf (PTI), is led by Imran Khan (a former cricket player who became a national hero after leading the Pakistan national team to victory at the 1992 Cricket World Cup, Pakistan’s first and only win at that competition). The PTI could look to gain on this in the next elections, but it is important to note that Punjab province accounts for the majority of the seats in the National Assembly and the PML (N) has historically had a very strong position in Punjab with a large amount of development work being executed over the past few years. Having said that, the next elections will be more hard fought than previously assumed. Economically, the China Pakistan Economic Corridor (CPEC) is not expected to be impacted by the political change given its strategic importance both economically and geo-politically. This is important as the CPEC is expected to add significant electric power capacity which should aid economic growth in the future.

In our “2017 Outlook” published in January, we had expected some amount of political noise, as well as currency depreciation, and given the ongoing political uncertainties, as well as the correction of the KSE100 Index by 12% since its peak in May 2017, valuations do not appear to be stretched, with the KSE100 Index trading at a trailing 12-month P/E of 9.0x, a discount to most frontier and emerging markets in the region.

The best performing markets for the fund this month were Bangladesh and Mongolia. In Bangladesh, performance was led by the fund’s largest stock holding, a pharmaceutical company whose GDR was up 9.1% and is still trading at a huge discount to its local listing. Other positive contributions in Bangladesh came from a shoe retailer, a tobacco company, and a telecom company, all of which have shown very good results for the June quarter. We continue to be positive on Bangladesh which we will write about in next month’s travel report. In Mongolia, performance was led by the fund’s junior mining holdings and a consumer beverage company which will see a merger between its and Heineken’s Mongolian beer and vodka businesses.

Besides Pakistan, performance was dragged down by Vietnam and Sri Lanka. Within Vietnam, the fund’s construction and industrial related companies saw a correction after most of them had a good run in the first half of 2017. The Sri Lankan market also corrected as it has also had a good performance in the first half of this year. There was no major negative economic or company specific news and hence this correction would not worry us unduly.

The best performing indexes in the AAFF universe in July were Mongolia (+8.2%), Bangladesh (+3.6%), and Cambodia (+1.3%). The poorest performing markets were Iraq (-4.4%) and Sri Lanka (-1.6%). The top-performing portfolio stocks this month were all from Mongolia: a coal mine (+54.5%), a gold mine (+34%), a brewery (+33.4%), and a junior copper/gold mine (+33.3%).

In July, we added to existing positions in Mongolia, Pakistan, Sri Lanka, and Vietnam. We did not sell or reduce any of our existing positions.

As of 31st July 2017, the portfolio was invested in 120 companies, 1 fund, and held 3.4% in cash. The two biggest stock positions were a pharmaceutical company in Bangladesh (8.4%) and an investment company in Myanmar (3.1%). The countries with the largest asset allocation include Vietnam (27.0%), Pakistan (22.7%), and Bangladesh (17.3%). The sectors with the largest allocations of assets are consumer goods (29.9%) and healthcare (15.2%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 15.65x, the estimated weighted average P/B ratio was 2.80x, and the estimated portfolio dividend yield was 3.86%.

Factsheet AFC Asia Frontier Fund – July 2017

Factsheet AFC Asia Frontier Fund (non-US) – July 2017

AFC Asia Frontier Fund Presentation (English)

AFC Asia Frontier Fund Presentation (Chinese-Traditional)

AFC Asia Frontier Fund Presentation (Chinese-Simplified)

AFC Iraq Fund – Manager Comment July 2017

AFC Iraq Fund Class D shares returned +1.7% in July as the market continued the process of correction and profit-taking that began in March.

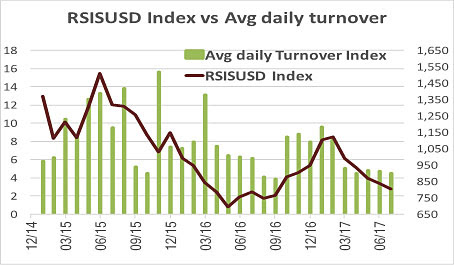

The equity market, as measured by the RSISUSD index, was down −4.4% for the month, recovering from lows of −10.0%, on further declining turnover. The average daily turnover for July was about 10% lower than the average of the prior four months during which the market was declining. The average turnover during the “up” months, i.e. November-February, was about 1.8x the levels of the down months (see chart below), lending support to the bottoming/recovery thesis following the −68% decline from the early 2014 peak to the May 2016 bottom.

Iraq Stock Exchange (ISX)

(Source: Iraq Stock Exchange (ISX), Rabee Securities, AFC)

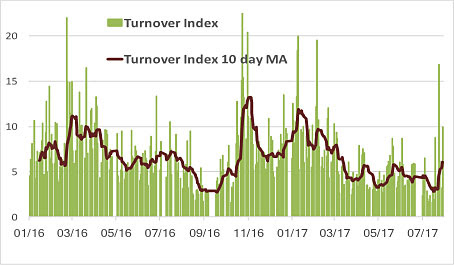

The same pattern was seen during the month with the average daily turnover on the days leading to the −10.0% drop at about a third of that during the days in which the market recovered (chart below). While a few days does not make a trend, nevertheless this is a positive indicator.

1Turnover Index on the ISX (green) vs 10 day moving average (red)

(Source: Iraq Stock Exchange (ISX), AFC)

Foreign selling continued to weigh on the market with the associated fears of the effects of further selling. In particular, as reported last month, one of the bluest chip banks bore the brunt of selling declining −9.5% in June following declines of −5.3% and −17.8% for the last prior two months respectively. This had a knock-on effect on other banks which declined in-tandem and dragged the market lower with them given the sector’s dominance of trading on the ISX. This continued in July with the bank declining a further −4.5% before local investors, encouraged by low valuations and a 10.5% dividend yield declared at the AGM held mid-month, started buying in size, which in turn provided a boost to sentiment with a pick-up in both prices and turnover in other banking stocks. Although local retail trading is dominated by speculation, locals tend to appreciate the true value of local assets especially at extreme valuations and, at least now, seem to have acted upon this. This was the opposite last year when equally attractive valuations failed to inspire such buying. Then, however, banks were still facing a difficult year ahead, had much lower levels of profitability which affected dividends and, crucially, local liquidity was still being squeezed.

The last 3 years were extremely challenging for banks in Iraq, however, the peak of the conflict post Mosul coupled with the reversal of the factors that crushed the economy should have an expansionary effect on the economy and thus provide the banks room to recover further and grow. These were discussed in a recent article Currently, local liquidity, as often reported here, is in the early phases of recovery and as such even this pick-up will be uneven.

The table below is a snapshot of current valuations of three of the bluest-chip banks, but to appreciate the significance, a quick review of the banking sector:

- Less than 20% of the population have bank accounts and out of those that do, about 60% have their deposits and loans with state banks, which in turn control over 90% of total assets and deposits;

- Lending is a small part of most bank’s income stream which is mostly from trade related fee income, other fee income, interest income from T-Bills, and deposits with the Central Bank

- Banks are extremely liquid; most assets are in cash and equivalents, consisting of cash deposits with other banks and with the Central Bank of Iraq (CBI), and CBI & Ministry of Finance T-Bills;

- Book values are understated vs banks elsewhere given the low interest income generation and the high dividend-pay-out ratio.

(Source: Company reports, ISX, AFC, Data based on latest trailing 12 month)

(Note: Prices as of 31 July 2017. Fundamental Data from the latest quarter (unaudited) and not average of last two years as in the last few quarters some banks have cut their loan books significantly through increased provisions and write-offs and enforcing loan repayments)

In a first for Iraq, the country priced USD 1 bln of independently fully syndicated 5-year bonds at a yield of 6.75% and it was about 7 times oversubscribed. Prior offerings were part of a support program; in 2006, it issued USD 2.7 bln as part of a restructuring of earlier debt while in February of this year it issued a USD 1 bln bond guaranteed by the US at a yield of 2.15%. The pricing coincided with the news that the IMF completed the second review of the Stand-By Arrangement with the release of USD 0.8 bln in further loans. At the time of writing, the current bond rallied further to yield 6.5%, clearly implying a favourable interest by global institutional investors, which should lead to an acceleration in the current FDI flows and eventually will be followed by equity inflows.

While it is true that no correlation lasts forever, the disconnect between the equity market action and that of the bond market seems to be similar to the same disconnect that took place in the first half of 2016 (see below). The explanation, logically, should be the same, namely that the bond, which trades institutionally and internationally, is not subject to the local liquidity constraints that continue to affect the local equity market.

Rabee Securities’ RSISUSD Index (green), Iraq’s USD 2.7 bln bond (gold) and Brent Crude (red)

(Source: Bloomberg as of 01/08/2017)

Finally, as if on cue, oil prices recovered strongly during the month, with Brent recently trading at over USD 52 from a low of about USD 44, adding further support to sentiment towards Iraq. Oil market sentiment seemed to have shifted from the thesis of ever increasing shale oil growth to: (1) focusing on the effects of decline rates of both non-US & non-OPEC production due to the cuts in capital spending in response to low oil prices over the last few years; and (2) emerging bottlenecks in shale production. In a nutshell, the said decline rates suggest that the growth last year in shale oil masked declines in non-US and non-OPEC production which will only accelerate in a few years just as shale oil production growth will moderate.

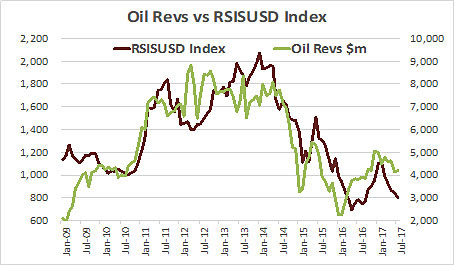

For Iraq, higher oil prices give a boost to government finances, given the sensitivity of the budget to production and prices which was explored in the later part of May’s market update. The chart below highlights the sensitivity of the market to oil revenues, especially since the decline in oil prices from mid-2014 onwards as shown in the red shaded areas. While oil revenues play a huge part in Iraq’s economy, other factors such as FDI and economic expansion also play major roles, as can be seen by the weaker influence of oil prices on the direction of the equity market shown in the green shaded areas.

(Source: Iraq Ministry of Oil (MoO), Rabee Securities, ISX, AFC)

(Note: Oil revenues data from MoO as of June, AFC estimates for July)

The comment made in previous newsletters that “a change of direction is at hand with the opportunity to acquire attractive assets that have yet to discount a sustainable economic recovery” is still very much in play but as mentioned before: “the recovery will likely be in fits and starts with plenty of zig-zags along the way as liquidity is still scarce with a time lag before it can filter down into the economy.”

As of 31st July 2017, the AFC Iraq Fund was invested in 14 names and held 3.3% in cash. The fund invests in both local and foreign listed companies that have the majority of their business activities in Iraq. The countries with the largest asset allocation were Iraq (97.2%), Norway (2.4%), and the UK (0.4%). The sectors with the largest allocation of assets were financials (51.9%) and consumer staples (24.4%). The estimated trailing median portfolio P/E ratio was 8.14x, the estimated trailing weighted average P/B ratio was 0.92x, and the estimated portfolio dividend yield was 4.19%.

Factsheet AFC Iraq Fund – July 2017

Factsheet AFC Iraq Fund (non-US) – July 2017

AFC Iraq Fund Presentation

AFC Vietnam Fund – Manager Comment July 2017

The AFC Vietnam Fund returned +1.9% in July with an NAV of USD 1,904.24, a new all-time high, bringing the net return since inception to +90.4%. This represents an annualised return of +19.6% p.a. The July performance of the Ho Chi Minh City VN Index in USD was +0.9% while the Hanoi VH Index gained +2.1% (in USD terms). Since inception, the AFC Vietnam Fund has outperformed the VN and VH Indices by +47.3% and +52.8% respectively (in USD terms). The broad diversification of the fund’s portfolio resulted in a low annualized volatility of 8.77%, a high Sharpe ratio of 2.20, and a low correlation of the fund versus the MSCI World Index USD of 0.30, all based on monthly observations since inception.

After an excellent finish to the end of the first half of the year, Vietnamese markets consolidated in the first three weeks of July. Strong buying interest resumed in the last week of July and brought the indices back into positive territory.

Market developments

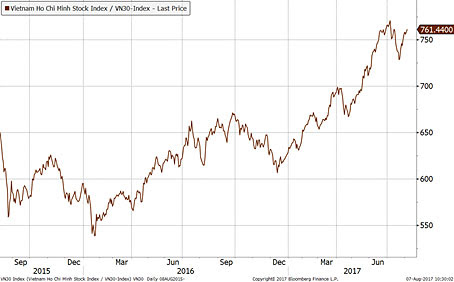

The VN30 index, which includes blue chips from both markets, corrected more than 6% from its top in early July before recovering most of its losses at month’s end. After breaking out of its long-term consolidation, the market now has to digest its recent gains which can be seen as a healthy pattern in a long-term bull market.

The medium-term outlook is not yet fully clear, but the sharp correction led the market to become short-term “oversold” from a technical perspective. These types of hefty short-term corrections are typical, especially during a long-term upward trend.

VN30 index, daily, 2 years

(Source: Bloomberg)

While we are closely watching market developments, our investment decisions are only marginally affected by those short-term swings and are only leading to adjustments of individual position sizes. With earnings season for the first half of the year in full swing, we are now in the midst of updating and analysing our holdings, and so far, we have not been disappointed by the business developments for most of our investments.

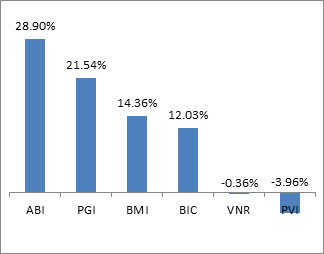

A very good example of our focus on undervalued stocks is our biggest position, Agricultural Bank Insurance Company (ABI), a retail insurance company which we have been accumulating for a while now. The total premium collected by insurance companies in Vietnam in the first half of 2017 grew 21% YoY to USD 2.07 bn, according to the Ministry of Finance. The estimated revenues from life insurance and non-life insurance is USD 1.22 billion and USD 0.85 bln, respectively. Among listed insurance companies, ABI had the highest growth rate in the first half of 2017. It has also been the fastest growing insurance company over the past 5 years with a CAGR of 22.5%.

Insurance premium growth in 1 H-2017

(Source: VCSC, HSX, HNX, AFC Research)

ABI is a retail insurer with more than 70% of their insurance premiums coming from individual clients. The company is selling its products through bank assurance with 3,500 branches throughout the country. It is not only the fastest growing insurance company, but also the most effective. In 2016 ABI recorded an ROE of 19.2%.

Revenue growth of ABI

(Source: VCSC, HSX, HNX, AFC Research)

ROE of insurance companies in 2016

(Source: VCSC, HSX, HNX, AFC Research)

With those outstanding fundamentals, ABI should trade at a premium to the sector. However, despite gaining more than 50% since the start of the year, the company is still trading at a deep discount of about 50% to the insurance sector average.

The average insurance premium in Vietnam currently stands at USD 30, much lower than the regional average in Southeast Asia at USD 74 and the global average of USD 595.

Vietnam’s fast-growing insurance market has great upside potential with its rapidly growing middle class. Also, the country has one of the world’s lowest life insurance penetration levels of less than 1% of GDP. This has prompted a number of foreign companies, including the UK’s Aviva Plc. and Canada’s Sun Life Financial Inc., to step up their presence in Vietnam through M&A activities and joint ventures over the past several months.

- In April, Aviva Plc acquired a 50% stake in Hanoi-based VietinBank’s life insurance joint venture, VietinBank Aviva Life Insurance Ltd (Aviva Vietnam).

- In late 2016 Sun Life took full control of the joint venture, PVI Sun Life Insurance Company Ltd. by acquiring the remaining 25% stake from PVI Holdings.

- In July 2017 Mirae Asset Life acquired a 50% stake in Prevoir Vietnam Life with a total value of USD 52.6 mln

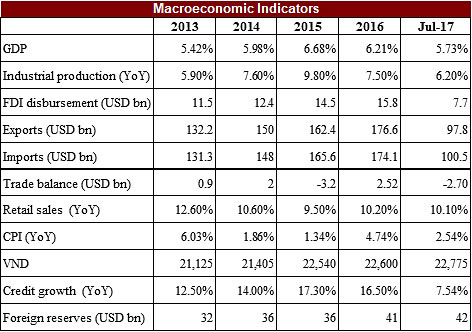

Economy

In July 2017, the State Bank of Vietnam announced record high foreign reserves of USD 42 bln, compared to USD 41 bln in June. FDI disbursement is the key factor which continues to help foreign reserves increase. In the first 7 months of 2017, total FDI disbursement reached USD 9.1 bln, increasing by 5.8%.

Export revenue continues to grow at 18.7%, having reached USD 115.2 bln in July. The recovery of Samsung Electronics had an important impact on Vietnam’s export numbers, with mobile phone exports increasing by 15% to USD 22.6 bln YTD.

The headline CPI continues to stay low at 2.52% which supports the Government’s effort to stimulate the economy by boosting credit growth. The core CPI in July was only 1.3%.

(Source: AFC research, SSI, GSO, SBV, VCB)

At the end of July 2017, the fund’s largest positions were: Agriculture Bank Insurance JSC (4.8%) – an insurance company, Sam Cuong Material Electrical and Telecom Corp (2.8%) – a manufacturer of electrical and telecom equipment, Pharmedic Pharmaceutical Medical JSC (2.4%) – a pharmaceutical company, Cantho Pesticides JSC (2.2%) – a manufacturer of agricultural chemicals, and National Seed JSC (1.9%) – an exporter of seeds.

The portfolio was invested in 78 names and held 2.8% in cash. The sectors with the largest allocation of assets were consumer goods (33.3%) and industrials (25.3%). The fund’s estimated weighted average trailing P/E ratio was 10.70x, the estimated weighted average P/B ratio was 1.79x and the estimated portfolio dividend yield was 6.71%.

Factsheet AFC Vietnam Fund – July 2017

AFC Vietnam Fund Presentation

AFC Travel Report – Cuba:

In April 2017, AFC contributing author John Enos spent five days traveling around Cuba. While we don’t invest in Cuba, it is always interesting to study and visit other frontier markets, especially those emerging from decades of being kept in the cold from the international community.

For more than half a century, Americans have been, for the most part, barred from visiting Cuba. As a result of The Blockade – a series of economic sanctions levied against Cuba in 1960 as a response to Cuba nationalizing US oil refineries without compensation – airlines were restricted from flying to Cuba and apart from rare organized tour groups (usually with the intention of study / cultural tourism) and the infamous Guantanamo Bay detention camp, Cuba has been completely off limits. Bold and adventurous travellers determined to visit often routed their flights through Cancun, Toronto, or the Bahamas, making sure to ask the Cuban customs agent not to stamp their passport to prevent suspicion being raised upon their re-entry to America.

This all started to change with the “Cuban Thaw” under former President Barack Obama. Cuba was removed from the US’s State Sponsors of Terrorism list, embassies were re-opened in both countries, and Obama visited the island in March 2016, the first US president to do so since 1928.

The sudden warming of relations between America and Cuba perfectly coincided with my move back to the US after 5 years in Asia and Africa, and I knew I had to take advantage of the opening once I was Stateside. In 2016, commercial flights from the US to Cuba started, and eight major carriers (including United, American, Delta, JetBlue) started serving Havana and other airports from a variety of US cities.

Technically, Americans are still not legally allowed to visit the country for tourism, unless their visit falls into one of 12 pre-approved categories, one of which is “people-to-people travel”. It’s all a bit of a legal gray area, but I knew a handful of friends who had recently visited and assured me that it wouldn’t be a problem.

Upon landing in Fort Lauderdale, Florida from Chicago, the woman at the Spirit Airlines counter gave me a Cuba visa form and, upon noticing my confusion, told me to “just tick the box for Intention: People-to-people travel and give me $100”. Apparently the airlines sell the Cuba visas at the last port of departure, and add their own visa processing service fee on top, making my visa cost nearly 1/3 the price of my return flight!

I landed in Havana’s José Martí airport shortly after lunch, and the arrival process was far easier than I’d expected. The customs agent seemed unfazed by my American passport, and although the airport was pretty old and outdated, everything seemed straightforward…until I walked outside to the money exchange counter.

American bank cards don’t work in Cuba, and there aren’t many ATMs in the country anyway. I had been warned ahead of time to bring Euros instead of USD, as dollars are penalized when converting to the local currency. The line to exchange money was the first of what would be many long lines that I would see in Cuba, and standing in a long line of travel-fatigued tourists in the muggy Havana heat for over an hour was not the best arrival experience to a country.

While in line, I noticed the Arrivals board, and was quite amazed at the variety of inbound flights arriving in Havana. I had assumed that, given the country’s isolation and economic sanctions that have stalled its development, transport links to Cuba would be relatively few and far between. On the contrary, the airport was teeming with passengers arriving from a diverse array of far-flung destinations: Moscow, Paris, Beijing, Rome, Istanbul, Montreal, Madrid. Apparently there is even a direct flight from Luanda, Angola to Havana with TAAG (Angola’s flag carrier), a nod to the strong bilateral ties forged over decades of shared Marxist-Leninist ideals.

With no ATMs and a penalty against changing USD, the issue of money in Cuba is confusing. To further complicate matters, there are two official currencies in Cuba: Cuban convertible pesos (CUCs, pronounced ‘kooks’) and Cuban pesos (CUPs / ‘national pesos’). CUCs are what tourists use, while Cuban pesos are what most Cuban state workers are paid their wages in. The exchange rate is 25 CUP per 1 CUC, however I never saw or used a national peso during my time on the island.

Finally, with $600 worth of CUCs in hand, I hailed a taxi and headed into town. Cuba’s old 1950s cars can be found everywhere – classic colorful Oldsmobiles, Chevrolet, Buicks, Fords, and Chryslers.

The drive in from the airport passes several iconic landmarks, including the Plaza de la Revolución, where Fidel Castro gave his famous speeches, and The Malecón, an 8km strip of road, seawall, and esplanade that epitomizes vintage Cuba and has been featured in many films shot in Havana.

Plaza de la Revolución in Havana. ‘Vas bien, Fidel’, translated as

‘You’re doing fine, Fidel’, became a slogan of the Revolution

The famous Malecón in Havana

Vintage cars cruising on The Malecón in Havana

One curious entrant into the rush of American companies looking to do business in Cuba has been Airbnb. Airbnb was one of the first movers, helping to link Cuban families offering ‘casa particulares’ with travellers looking for an authentic Cuban homestay experience. The fact that Airbnb exists throughout Cuba makes planning a trip much easier, as connecting with hotels to make reservations is a difficult process – internet and mobile phone access is still quite sporadic across the island. I met up with my two friends and former colleagues from Cambodia at the Airbnb we had reserved in Old Havana, and we spent our day exploring the beautiful decay of Old Havana, which was bustling with tourists and Cubans going about their daily lives.

A typical calle (street) in Old Havana

A man strolls by a vintage 1950’s car in Old Havana

After our day walking around Havana, we set out to experience life in the rural countryside, and arranged a taxi for the 4 hour drive to Viñales, a small agricultural town reliant on nearby tobacco farms and set against picturesque mountains. The tobacco and leaves are used for hand-rolled Cuban cigars, a world-renowned export for the country and another industry crippled by the embargo. In Viñales, we rented bicycles and pedalled across hilly roads under the blistering Caribbean sun, visiting a cigar-rolling factory, several caves, and the beautiful landscape.

A man hand rolls Cuban cigars in his workshop

The hills protruding from tobacco fields in Viñales

Old cars cruising through rural tobacco fields

From Viñales, we planned to set off to Trinidad, a UNESCO World Heritage Site and famed old coastal city. All taxis had to double back through Havana, and it turned out that our driver from Viñales decided he was only taking us as far as Havana, and that he’d call a friend to take us from Havana to Trinidad. This proved frustrating, as we spent nearly two hours sitting in a hot parking lot in Havana waiting for his friend to show up. It was another reminder of the slow pace of life in Cuba, and most Cubans have spent much of their lives standing and waiting in long lines (we regularly saw dozens of people in line at bakeries, corner stores, and bus stations) – shortages and queuing are all too prevalent in Communist countries, it seems.

The very long ride to Trinidad took us through the rural and largely undeveloped middle of Cuba (see map below)

What I found most striking about the drive was the utter lack of billboards, advertising, or any signs of commerce. Save for a political propaganda billboard that we would see every 100km or so (usually proclaiming “Viva La Revolucion” or another Castro slogan), there was no advertising of any sort. Even in some of the least developed countries I’ve visited – places like Somalia, Haiti, or Kyrgyzstan come to mind – one would still see billboards advertising telecom operators, laundry detergent, Coca-Cola, money remittance services, or beer. In Cuba, this was entirely absent, and it was refreshing. The long and hot drive was actually quite peaceful given the serene environment and a feeling of ‘going back in time’ to untouched Cuba.

The author with a rare billboard. Cuba Es Nuestra…‘Cuba is ours’

Trinidad was settled in the 1500s and is known to this day for its Spanish Colonial architecture, much of which has been well preserved. The town was at peak importance during the heyday of Cuba’s sugar industry, but today the main economic sector is tobacco processing.

I was most impressed by the colorful old buildings we saw walking around Old Trinidad, and we enjoyed our multiple nights there drinking Cuba Libres (rum & Coke) and eating ropa vieja ‘old clothes’ in Spanish, a dish of shredded beef and vegetables found all over Cuba. On our last full day, we rented bikes and cycled the 15km or so to the beach, arriving at a magnificent white sandy beach. A pleasant side effect of Cuba’s relatively nascent tourism industry is that it has been saved from the huge resorts and mass tourism that has swept much of the Caribbean. As we sat on the beach spending the last of our CUCs on ice cold Cristal beers and smoking one last Cuban cigar, we all agreed that we were lucky to have visited Cuba before it changed.

A cobblestone street in Trinidad in central Cuba

Sorry, comments are closed for this post.