“Consistency is far more important than

rare moments of greatness.” – Scott Ginsberg.

AFC Asia Frontier Fund (AAFF) USD A-shares lost -3.5% in January 2016. The fund this month outperformed the MSCI Frontier Markets Asia Index (-6.3%), the MSCI Frontier Markets Index (-6.8%), and the MSCI World Index (-6.1%). The performance of the AFC Asia Frontier Fund A-shares since inception on 31st March 2012 stands now at +34.2% versus the MSCI Frontier Asia Index which is down -3.2% and the MSCI Frontier Index which is down -3.0% during the same time period.

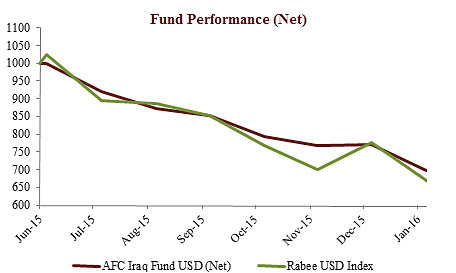

AFC Iraq Fund Class D shares returned -9.9% in January 2016, this was an outperformance against the Rabee RSISX USD Index (RSISUSD), which returned -13.7% in USD terms. The fund has outperformed the RSISUSD by +2.6% since inception.

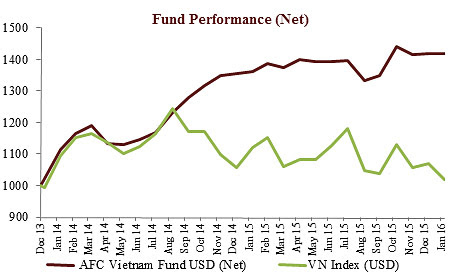

The AFC Vietnam Fund lost -0.1% in January, bringing the net return since inception to +41.8%. By comparison, the January performances of the Ho Chi Minh City VN Index and the Hanoi VH Index were -4.8% and -2.8% respectively (in USD terms). Since inception the AFC Vietnam Fund has outperformed the VN and VH Indices by +40.0% and +34.9% respectively (in USD terms).

AFC in the Press

Mr. Ahmed Tabaqchali, CIO of AFC Iraq Fund, will be speaking on Gavin Serkin’s Emerging Opportunities Radio Show hosted by frontierfunds.org on the 22nd of February starting from4:30pm GMT.

Upcoming AFC Travel

If you have an interest in meeting with our team during their travels, please contact Peter de Vries at pdv@asiafrontiercapital.com.

| Phnom Penh | 1st – 9th February | Scott Osheroff |

| Tokyo & Nagoya | 7th – 12th February | Andreas Vogelsanger |

| Bangkok | 16th February | Scott Osheroff |

| Vientiane, Laos | 13th – 18th January | Scott Osheroff |

| Tehran | 19th February – 4th March | Thomas Hugger |

| Dubai, UAE | 1st – 3rd March | Thomas Hugger & Ruchir Desai |

| Hong Kong | 1st – 11th March | Andreas Vogelsanger |

| Ho Chi Minh City | 14th – 18th March | Andreas Vogelsanger |

| Zurich / Basel | 22nd – 24th March | Thomas Hugger |

AFC Asia Frontier Fund – Manager Comment January 2016

AFC Asia Frontier Fund (AAFF) USD A-shares lost -3.5% in January 2016. This month, the fund outperformed the MSCI Frontier Markets Asia Index (-6.3%), the MSCI Frontier Markets Index (-6.8%), and the MSCI World Index (-6.1%). The performance of the AFC Asia Frontier Fund A-shares since inception on 31st March 2012 now stands at +34.2% versus the MSCI Frontier Asia Index which is down -3.2% and the MSCI Frontier Index which is down -3.0% during the same time period.

January was amongst the toughest months for global markets since 2008/2009. Most relevant indices had lost double digit returns by the third week of the month but markets saw a recovery in the last week of the month. As expected, the worries were the economic slowdown in China and the impact of low oil prices on geo-politics in the Middle East. Investor sentiment towards frontier markets in Asia was also impacted by these concerns. An economic slowdown in China fundamentally does not impact most of our fund’s larger markets as these countries are not major exporters to China. In fact, these countries (Bangladesh, Pakistan, Sri Lanka, and Vietnam) import commodities and are benefitting from lower commodity prices due to the China slowdown. Mongolia is the only major exception which depends on exports to China but the fund’s exposure to Mongolian resource stocks is not large (3.4%).

Given the global sentiment towards equities in general last month, the fund had its third worst monthly performance since inception but still managed to do better than its benchmark as well as relevant indices. There are a few reasons for this which we have mentioned in our previous manager comments. The fund has very little exposure to oil and gas stocks and follows a diversified approach to managing risk. This has helped especially over the past few months. Furthermore, certain large holdings in Pakistan ended the month in positive territory (a pharmaceutical company and a cement company). Fundamentally, not much has changed significantly over the past month and we would be buyers if the market were to come down more as fundamentals in our key markets remain relatively stable.

Vietnam witnessed a political transition during the month as the government held its 12th National Congress in which new leaders were elected/shortlisted. Mr. Nguyen Thanh Dung, the current Prime Minister, stepped down from his position and the position of General Secretary was retained by Mr. Nguyen Phu Trong. The outgoing Prime Minster was known for his reform-oriented nature and it would be interesting to see what the motivations of the new Prime Minister will be with respect to the economy. It would be surprising to see reforms and economic development stalling all together given the importance that foreign investment and exports are playing in the development of the country. We will write more on this as and when we know more about the Prime Minster elect and we also plan to visit the country in March.

The State Bank of Pakistan maintained key interest rates at the same level but its policy statement sounded positive regarding economic growth due to low inflation, a pickup in fixed investment loan growth, and investments by China in the China Pakistan Economic Corridor. We will be attending a Pakistan investor conference in Dubai in March and will write more on the country in the upcoming newsletters. We remain positive on the country.

The only index in the AAFF universe that was up in January was Laos, which finished the month up +0.2%. The next best performing indexes were Cambodia with -1.0% and Bangladesh with -1.9%. The poorest performing markets were Iraq with (-13.7%) and Mongolia (-9.0%). The top-performing portfolio stocks were a Mongolian mining company (+50.0%), followed by a Vietnamese food producer (+43.5%), a Mongolian property investment company (+32.3%), and a Bangladeshi food producer (+23.6%).

In January, we added to existing positions in Iraq, Mongolia, Pakistan, and Vietnam and also added two car manufacturing companies in Pakistan to the portfolio. We completely exited an agricultural chemical company in Vietnam, a home products company in Sri Lanka, an Iraqi bank, and an Iraqi beverages company. We reduced our holdings in a Pakistani pharmaceutical company and a Mongolian consumer product company.

As of 31st January 2016, the portfolio was invested in 105 companies, 1 fund, and held 6.51% in cash. The two biggest stock positions are a pharmaceutical company in Bangladesh (6.0%) and a Pakistani pharmaceutical company (5.2%). The countries with the largest asset allocation include Vietnam (31.0%), Pakistan (19.1%), and Bangladesh (15.8%). The sectors with the largest allocation of assets are consumer goods (41.7%) and pharmaceuticals (15.4%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 13.99x, the estimated weighted average P/B ratio was 1.48x and the estimated portfolio dividend yield was 3.3%.

For more information about Asia Frontier Capital’s Asia Frontier Fund please click the following links:

Factsheet AFC Asia Frontier Fund – January 2016

Factsheet AFC Asia Frontier Fund (non-US) – January 2016

AFC Asia Frontier Fund Presentation (English)

AFC Asia Frontier Fund Presentation (Chinese-Traditional)

AFC Asia Frontier Fund Presentation (Chinese-Simplified)

AFC Iraq Fund Manager Comment January 2016

AFC Iraq Fund Class D shares returned -9.7% in January 2016, an outperformance against the Rabee RSISX USD Index (RSISUSD), which returned -13.7% in USD terms. The fund has outperformed the RSISUSD by +2.6% since inception.

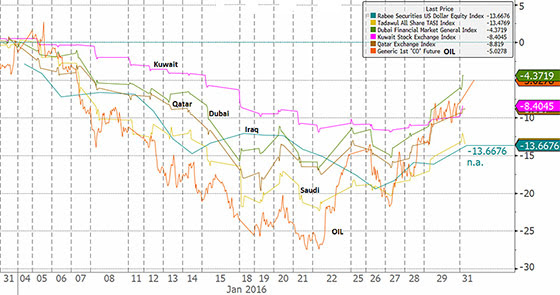

The Iraq Stock Exchange (ISX)’s dismal January performance played out across the oil producing countries of Saudi Arabia, Kuwait, Qatar, and the UAE which dived and swooned with the collapse in oil prices in almost perfect harmony as the chart below and the table show. The year’s ugly start was rung by the fall of the Chinese equity markets and subsequent fears for the health of the global economy drove the decline in oil prices which was intensified by fears of the return of Iranian oil to world markets. Brent Crude bottomed on 20th January, down -27% for the year, while the markets bottomed a day later with Iraq (as measured by the RSISUSD) down -15%, Kuwait -12%, Dubai -16%, Qatar down -15% and Saudi Arabia down -21% as measured by local stock exchange indices. All markets recovered somewhat by month end again in-line with the recovery in oil prices.

RSISUSD Index, KSA’s Taduwl Index (Saudi), Dubai’s DFM Index, Kuwait’s KSE Price Index, Qatar’s Index versus crude oil price.

(Source: Bloomberg)

Within the ISX almost no stock was spared during the month, with all of the RSISUSD components contributing a share of the -13.7% decline with Investment Bank of Iraq down -23.5%, Mosul Bank -16.0%, Mamoura Real Estate -14.6%, and heavyweights Bank of Baghdad & Gulf Commercial Bank each down -13.7%. Relative outperformers were Baghdad Soft Drinks (-7.2%) which was up over 50% in December and Asiacell down -5.5%.

The RSISUSD’s decline of -13.7% for January 2016 comes on the back of the declines of -22.7% in 2015 and -25.4% in 2014 for a total of -50.2% over the period, putting the market in deep bear market territory. As stated last month, these declines were kicked-off by violence & political conflict ahead of the parliamentary elections in April 2014, intensified by the ISIS occupation of Mosul & a third of the country in June 2014, prolonged by the double whammy of the high cost of war and lower oil prices in 2015, and finally by the exaggerated fears that led to the oil price collapse in January 2016. Current levels are exceptionally attractive as the market can start to discount the prospects of recovery with the roll-back of ISIS, the positives of Iran’s re-connection with the world economy, while closer to home corporate earnings reported so far for 2015 companies are showing promise for the strong & well placed companies.

The oil price collapse triggered fears for the health of the strained government budget with various rumors making the rounds, from the failure of the government to make salary payments to the health of the banking system. Together they added to the ISX liquidity strains of the last few months which drove prices lower, while net foreign flows, as measured by proxy portfolio flows, reversed the December recovery and added to the declines of the later months of 2015. Average traded volumes for the month of almost USD 15 million were in line with the December figures vs the 2015 monthly average of about USD 18 million. Monthly averages were USD 25 million in 2014 and USD 38 million in 2013.

Proxy flows

(Source ISX, IDC, Rabee Securities & AFC)

Within this tough environment the stronger companies continue to show the disparity between perceived risk in Iraq, which is significantly higher than the actual risk, high as it is. In particular, Baghdad Soft Drinks reported revenue growth in 2015 of +14% and operating profits growth of +60%, while Mansour Bank reported 2015 revenue growth of +14% and pre-tax profits growth of +18%.

Reiterating the comments made last month, the portfolio was constructed with a focus on the long term and we believe that the fund’s holdings are now well positioned to capture the post-conflict Iraq opportunity.

Political developments

The momentum for the return of stability to the region in general and Iraq in particular continues this month with two major developments that seem to progress irrespective of the obstacles, real or contrived, placed on them. Iran’s reconnection with the world, economically and politically, went ahead sooner than expected with the removal of sanctions irrespective of the fireworks sparked by the escalating tensions between Iran and Saudi Arabia. The first steps in the Syrian peace process are underway in-spite of prevailing pessimism and negative noise emanating from various players reflecting the overwhelming needs to resolve this conflict.

Looking at the portfolio, as of 31st January 2016, the AFC Iraq Fund was invested in 14 shares and held 1.2% in cash. As the fund invests in both local and foreign listed companies that have the majority of their business activities in Iraq, the countries with the largest asset allocation were Iraq (94.1%), Norway (4.3%), and the UK (1.6%). The sectors with the largest allocation of assets were financials (45.3%) and consumer staples (27.7%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 15.96x, the estimated weighted average P/B ratio was 1.18x, and the estimated portfolio dividend yield was 0.75%.

For more information about Asia Frontier Capital’s Iraq Fund, please click the following links:

Factsheet AFC Iraq Fund – January 2016

Factsheet AFC Iraq Fund (non-US) – January 2016

AFC Iraq Fund Presentation

AFC Vietnam Fund – Manager Comment January 2016

To read this month’s fund update in German please click here.

The AFC Vietnam Fund Vietnam Fund lost -0.1% in January, bringing the net return since inception to +41.8%. By comparison, the January performances of the Ho Chi Minh City VN Index and the Hanoi VH Index were -4.8% and -2.8% respectively (in USD terms). Since inception the AFC Vietnam Fund has outperformed the VN and VH Indices by +40.0% and +34.9% respectively (in USD terms).

January is historically a strong month and we wouldn’t dare to imagine what would have happened if this year’s January scenario would have played out in the historically weak September month. For many exchanges, this was the weakest January since 2009, and the major stock markets ended the month with a loss of -6% to -9% (Shanghai was even down by -23%). Some markets were down more than 10% at some point during the month (e.g. Tokyo -16%). Vietnam went through a significant correction as well at around the middle of the month but the two indices recovered slightly and closed the month at -5.8% in Ho Chi Minh City and -3.9% in Hanoi. A fair number of the companies that the fund is invested in reported their 2015 results and many of them were better than our expectations. With some of those stocks rising despite the downward trend, our total losses were very limited. Emerging market currencies were generally weaker against the USD but the Vietnamese Dong bucked this trend and strengthened about 1% versus the USD.

Major Indexes in January: Dow, Nikkei, Dax, Shanghai, Ho Chi Minh, AFC Vietnam Fund, AFC Frontier Fund

(Source: Bloomberg)

The reasons for this bumpy start of the year are not really easy to understand. The fact that many banks will probably be hit with bad loans from the energy sector shouldn’t come as a big surprise. The constant fear of a “hard landing” in China is neither new nor sustainably proven. The massive capital outflows from China, which are often called as one of the main reasons for the current scepticism about China, can be refuted according to the latest figures from BIS (Bank for International Settlements). Both the short- as well as long-term USD liabilities of Chinese companies fell by 60% and 20% respectively and are the main reasons for this outflow. This would be very positive in the medium term and absolutely risk averse! Comments that the economic statistics in China are to be treated with caution and that they are sometimes manipulated are likely true – but that has been the same for the past 20+ years. By the same token one could question the reliability of certain western economic data like inflation numbers as well. Undoubtedly, the Chinese economy is slowly but surely, by orders from the “top”, transforming from a cheap manufacturing and export-oriented model to a Western-style consumer driven society. Meanwhile, 40% of the economic output is now for domestic consumption. Consumer spending is booming in contrast to industrial production and it is estimated to grow by 8-10% in the coming years. In other words, even with a stagnation of the industry, the baseline growth is already at 4% and the demand for all types of raw materials from Chinese consumers (in addition to other “new” consumers from emerging economies) is constantly increasing.

Vietnam, however, is still about 15-20 years behind China’s development and benefits from the shift of production from China to Vietnam. Due to the difference in size between the two countries, a few percentage points of this “manufacturing shift” are sufficient to keep the growth in Vietnam at a very high level, even with a weaker global growth, as long as the domestic demand can be maintained at a reasonable level. It is impressive to note that the economic recovery in the major cities such as Ho Chi Minh City with about 10% is significantly higher than in the rest of the country, where a growth rate of 6.5 – 7% for the next couple of years can be expected.

One could easily draw the conclusion that with falling raw material prices of up to 75% over the past 18 months that demand has fallen accordingly. This is far from the truth, however, with world economic growth of around 3%. Global oil consumption has actually increased by about 12% over the past 10 years. It is therefore also misleading to look at falling oil prices as a sign of an ailing world economy. The current oil price decline is not attributable to a collapse in demand, but rather to politically motivated production increases. Economic hardship of some oil producing countries doesn’t necessarily allow them to reduce production. We are therefore witnessing the greatest wealth redistribution in recent decades away from some oil-producing countries – 2/3 of the world’s oil production has its origin from 10 countries – towards other countries and companies and of course a large portion of the world’s population which is benefitting from falling energy prices.

The Communist Party in Vietnam elects their new leadership once every five years. The current reformist and Prime Minister Nguyen Tan Dung has come up to the maximum reign of 10 years and he therefore flirted with the job as the Party Secretary General. Unfortunately, this has not worked out, because on one hand he has already exceeded the maximum age limit of 65 years for the job and on the other hand he doesn’t enjoy enough support from the party to grant him an exception to this rule. The current Party Secretary General Nguyen Phu Trong was re-elected and the former Deputy Prime Minister Nguyen Xuan Phuc will most likely be the new Prime Minister. It is generally expected that economic reforms will continue and that there will be no major changes in direction in the economic policy in Vietnam.

In January the fund’s largest positions were: Sam Cuong Material Electrical and Telecom Corp (3.5%) – a manufacturer of electrical and telecom equipment, Doan Xa Port JSC (2.0%) – a logistics company, Thien Long Group (1.9%) – a manufacturer of office supplies, Nui Nho Stone JSC (1.9%) – a stone mining company, and, Thuan An Wood Processing JSC (1.7%) – a wooden furniture manufacturing company.

The portfolio was invested in 84 shares and held 3.0% in cash. The sectors with the largest allocation of assets were consumer goods (37.9%) and industrials (23.5%). The fund’s estimated weighted average trailing P/E ratio was 7.39x, the estimated weighted average P/B ratio was 1.11x and the estimated portfolio dividend yield was 6.42%

Factsheet AFC Vietnam Fund – January 2016

AFC Vietnam Fund Presentation

Bangladesh Travel Report – January 2016

In line with our process of being on the ground in the countries we invest in, Senior Investment Analyst of the AFC Asia Frontier Fund, Ruchir Desai, travelled to Bangladesh to attend an investor trip in Dhaka.

By Ruchir Desai, Senior Investment Analyst

Since this was my first visit to Bangladesh I was looking forward to it as we have been quite bullish on the consumer story in Bangladesh given the large young population with rising disposable incomes. This was not the first time in Bangladesh for the AFC team, as our fund manager and CEO Thomas Hugger has visited on multiple occasions. Just to give a quick snapshot, the country has a population of ~160 million with a median age of 26 and GDP per capita of just above USD 1,000, which is rising. These demographics reflect the potential that the country holds in the long run and the fund has exposed itself primarily to consumer related companies in Bangladesh.

Dhaka airport is like that of any developing economy but it serves its purpose. Getting through immigration on arrival was not time consuming as there were not many foreign passport holders in the “foreigners” line. This is kind of a good sign as the country is not yet on the radar of most foreigners except for the global garment industry. Garment exports from Bangladesh were about USD26 billion in the latest financial year and account for around 82% of the country’s exports. Bangladesh has drawn a lot of global retailers to source from the country due to low wages compared to China and the garment industry now employs about 4 million employees.

I have heard a lot about the traffic in Dhaka and I guess seeing is believing in this case. Getting out onto the main highway (Dhaka-Mymensingh highway) from the airport took around 20 minutes which would be 5 minutes if there was no traffic and it was almost 11pm. This highway connects Dhaka city to the outskirts of Dhaka as well as other cities and so is always quite busy. Hats off to the traffic policeman who was managing the chaotic traffic as I did not see any traffic lights at this junction. Dhaka city has a population of close to 9 million so to have such traffic situations in a large developing city is not surprising.

The meetings were taking place at the Westin; the same place where I was staying. There are only a few well established hotel chains operating in Dhaka and that is why room rates are high at USD200+ per night. The Westin and Radisson have been around for quite a few years but Le Meridien has opened recently next to the airport and a JW Marriott is under construction as well, which suggests that the city offers potential to multi-national hotel chains, while it also indicates that room rates might go down in the future.

Over the next two days of meetings, I got a chance to meet sixteen companies across the banking, consumer staples, energy, financial services, pharmaceutical, power utility, and telecom sectors. One thing that stood out from the meetings with corporates was the discussion about political stability until the next election in the end of 2018.

Bangladesh witnessed a lot of political protests and blockades in the run up to the 2014 elections which were held in January 2014. As a result, the last quarter of 2013 and early part of 2014 impacted the country’s economic activity. Things settled down towards the second half of 2014 but political protests marked the beginning of 2015 and economic activity was again impacted in the first quarter of 2015. Things have settled down since then and the past 9 months have not seen any political protests or blockades as the current government in power, led by Awami League’s Sheikh Hasina, has strengthened its position while the opposition, led by Khaleida Zia of the Bangladesh Nationalist Party, has been weakened. Just to give a brief background, the opposition had boycotted the 2014 elections as the current government did not meet their demands regarding certain constitutional amendments. This resulted in the opposition resorting to political protests and blockades but this did not stop the elections from going ahead and the ruling Awami League was back in power as they did not have any opposition. The tactics used by the opposition over the past few years have weakened their support base and as a result, political stability has returned for the time being.

This political stability is obviously a good thing for the economy as corporates and consumers have been holding back on expenditures. With stability expected in the near term, banks expect loan growth to pick up while consumers could look to purchase more expensive consumer discretionary items such as apartments. Mortgage financing in Bangladesh is a growing market with housing loan penetration at less than 3% and one could see this type of financing pick up in the coming years on increasing urbanisation and income levels.

Besides loan growth, an industry which is expected to do well over the coming years is the Bangladeshi pharmaceutical industry. This industry’s exports is still in the nascent stage of development with exports at only around USD 75 million which is just around 5% of the overall Bangladeshi pharmaceutical industry’s total sales. The domestic market also offers potential given higher healthcare spending due to rising disposable income and urbanisation. Between 2010-2014, the domestic pharmaceutical market has grown at a compounded rate of 15.3% per annum.

Traffic in Dhaka city

(Source: Asia Frontier Capital)

Food Court in Jamuna Future Park

(Source: Asia Frontier Capital)

From the consumer companies I met, the one which has done exceptionally well and continues to have large market potential is a domestic biscuit company. The company has seen double digit growth rates in revenue and earnings over the past few years as its distribution network and brand have been well established. Furthermore, the price points of its products are focused towards the sizeable market opportunity that the country offers. For example, a packet of biscuits from this company sells at 12-15 taka which is around USD15-20 cents. Imports are also not a threat as import duties make these products almost six times more expensive.

After the second day of meetings, some of the attendees took a walk around the surrounding areas of Gulshan. This is where the Westin is located and Gulshan is one of the upmarket areas of Dhaka where many embassies are located. The walk-about was intended to get a feel of the city and also check out some of the retail stores, pharmacies, and grocery shops. First off was the most well established shoe retailer in Bangladesh and maybe even the sub-continent. The shop was fairly crowded for a Tuesday evening with affordable price points for most products. You can get a pair of leather shoes for USD30-40. Since this company is listed it is a great consumer discretionary story for this developing economy. We also ventured into one of the pharmacies to check out the range of products that were on offer given the potential that this industry holds. Lastly we checked out a grocery chain named Shwapno (the Bengali word for dream) to get a look at which products were being stocked by the grocery since many products being sold are produced by listed companies we had met earlier. Checking out the local grocery store is a good way to get a grasp of what is selling well or which products are being promoted.

The latter half of the evening was spent checking out Jamuna Future Park which is supposed to be the largest mall in South Asia. Since we were there towards closing hours one couldn’t get an idea of footfalls but I am told it gets crowded on weekends. The mall is spread over five floors along with a food court and multiplex and many of the shops are wasting a lot of space given the way they are designed. You wouldn’t see shops so big in Hong Kong or Singapore or even Mumbai! Most of the brands at the mall are local but it wouldn’t be surprising to see this change in the coming years as consumer disposable incomes rise.

Open Market outside of Dhaka

(Source: Asia Frontier Capital)

Farmland Outside of Dhaka

(Source: Asia Frontier Capital)

The last day was spent doing factory visits. The first was to the leading biscuit company in Bangladesh with the factory around two hours south of Dhaka. Getting out of city limits gave a good idea of logistical issues companies are facing as there are occasions when roads are clogged up and traffic does not move. There is obviously room for improvement here like in most developing countries. Getting to see the biscuit factory first hand was a good way to get an idea of which brands of products are in demand and the managers of the factory, who have been with the company for more than a decade, run a pretty tight ship. The last stop was to the third largest pharmaceutical company by revenue but the biggest in terms of export revenue. The company’s factory was at Tongi, which is north of Dhaka, so we were on the road again for another couple of hours. Our lunch included Hilsa fish which is the national fish of Bangladesh, which is tasty but requires care as it has many bones in it. After lunch we got a chance to tour the manufacturing facilities which was insightful as pharmaceutical manufacturing is carried out in a very clean and safe guarded environment. It was good to know the company is taking the right precautions as it has recently got approval from the US FDA for this facility and it will begin exporting a blood pressure drug to the US later this year. Generic pharmaceutical companies in Bangladesh have a slight cost advantage over India given lower wages and it seems this is only the beginning of increasing pharmaceutical exports from Bangladesh.

Three days of company meetings combined with the experience of city life and visits outside of Dhaka gave me a good opportunity to gauge the potential of Bangladeshi companies. Though the country could face political uncertainty again, the young population of the country like many of its neighbours want to move forward economically and they form a rising consumer class which should offer opportunities to consumer-focused companies over the next decade. Though political uncertainty could come up at times, the country’s macro stability is good, with rising foreign exchange reserves and a manageable fiscal deficit. Low oil prices are a positive for the economy as the country imports most of its fuel needs. Lower oil prices have not been passed onto the consumer yet and this could happen in 2016 which is another positive for consumer spending. With Bangladesh expected to post the third fastest GDP growth globally in 2016 at 6.5%, the outlook for the country is positive and I look forward to visiting Dhaka again.

I hope you have enjoyed reading this newsletter. If you would like any further information please get in touch with me.

With the Chinese New Year around the corner, the AFC team in Hong Kong wishes you a happy health and prosperous Year of the Monkey!

KUNG HEI FAT CHOY and kind regards,

Thomas Hugger

CEO & Fund Manager

th@asiafrontiercapital.com

Asia Frontier Capital Limited

89 Nexus Way, Camana Bay

Grand Cayman KY1-9007

Cayman Islands

Disclaimer:

This document does not constitute an offer to sell, or a solicitation of an offer to invest in AFC Asia Frontier Fund, AFC Asia Frontier Fund (non-US), AFC Iraq Fund, AFC Iraq Fund (non-US), AFC Vietnam Fund or any other funds sponsored by Asia Frontier Capital Ltd. or its affiliates. We will not make such offer or solicitation prior to the delivery of a definitive offering memorandum and other materials relating to the matters herein. Before making an investment decision with respect to our Funds, we advise potential investors to read carefully the respective offering memorandum, the limited partnership agreement or operating agreement, and the related subscription documents, and to consult with their tax, legal, and financial advisors. We have compiled this information from sources we believe to be reliable, but we cannot guarantee its correctness. We present our opinions without warranty. Past performance is no guarantee of future results. © Asia Frontier Capital Ltd. All rights reserved.

The representative of the funds in Switzerland is Hugo Fund Services SA, 6 Cours de Rive, 1204 Geneva. The distribution of Shares in Switzerland must exclusively be made to qualified investors. The place of performance and jurisdiction for Shares in the Fund distributed in Switzerland are at the registered office of the Representative.

By accessing information contained herein, users are deemed to be representing and warranting that they are either a Hong Kong Professional Investor or are observing the applicable laws and regulations of their relevant jurisdictions.

GO TOP

You are receiving this newsletter because you have subscribed via our website or have shown interest in frontier markets investing with our company at some stage in the past. If you would prefer not to be on our distribution list please click on the word unsubscribe to be removed from our newsletter list and all future correspondence. If you are changing your email address please send us a quick email to info@asiafrontiercapital.com in order to notify us of your new email so that you can continue to receive our newsletter.

Sorry, comments are closed for this post.