“While it might seem that anyone can be a value investor, the essential characteristics of this type of investor – patience, discipline, and risk aversion – may well be genetically determined.”

– Seth Andrew Klarman is an American value investor, hedge fund manager, philanthropist, in the hedge fund manager hall of fame, and founder of the Baupost Group, a Boston-based private investment partnership

AFC Funds Performance Summary

During February, the AFC Asia Frontier Fund received a record single month net inflow of USD 2.5 million. The AFC Asia Frontier Fund has now solidly passed the USD 20 million mark and AUM now stands at USD 22.1 million while the AFC Vietnam has a total of USD 31.1 million under management. The upsurge in subscriptions is another clear testimony for the solid track record AFC has achieved over the past few years, alongside low volatility, as well as providing informative updates through our newsletter which we hope you find interesting to read.

February 2017 was generally a positive month for our frontier markets, adding to a positive January, with most markets posting significant advances for the year so far. Our funds fared less well than their benchmarks this month, as we are more broadly invested and the increase in share prices was generally concentrated in the larger companies, financial stocks and index constituents. Since we follow a benchmark agnostic approach to investing, we may lag the respective benchmarks in certain months, but it is our belief that this approach is an important factor in creating long term outperformance.

The AFC Asia Frontier Fund returned −1.1% in February compared with the MSCI Frontier Markets Asia Index which went up +0.8% and the MSCI Frontier Index which was down −0.4%. The fund is now up +75.8% since inception, which corresponds to an annualized return of +11.9% p.a.

The AFC Iraq fund returned −0.1% in February, and is up +10.8% YTD.

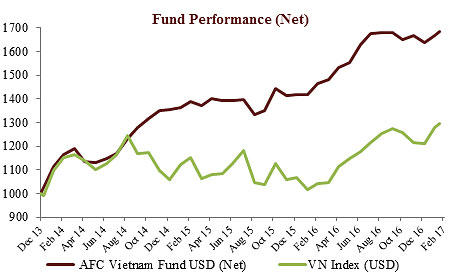

The AFC Vietnam Fund returned +1.1% in February compared with the VN-Index in USD, which increased by +1.1%. The fund is now up +68.5% since inception, which corresponds to an annualized return of +17.4% p.a.

Ahmed Tabaqchali, the CIO of the AFC Iraq Fund, was interviewed for a podcast by Chris MacIntosh of Capitalist Exploits. Click here to see the article and hear the hour-long podcast titled “Iraq: What You Haven’t Been Told”.

Last month, BarclayHedge ranked our AFC Asia Frontier Fund in the top 10 funds for 2016. This month BarlcayHedge has also announced their rankings for the last 3 years up to the end of 2016. AFC Asia Frontier Fund ranks in the top-10 in the broader range of funds classified as Emerging Markets – Asia, a group containing a total of 194 funds, which places the fund in the top 4 percentile. The AFC Asia Frontier Fund was ranked #7 with an annualized return of +19.12% p.a., while the #1 spot was taken up by a fund with a return of +24.49%. All funds in positions 1-6 were single country funds, and amongst the top 10, in terms of risk, measured by lowest drawdown or highest Sharpe ratio, AFC Asia Frontier Fund was the best, while it also had the lowest correlation versus the S&P500

In addition to this recognition, last month CNBC / Allocator’s Investors Choice Awards 2017 announced that the AFC Asia Frontier Fund was chosen as a finalist in the section “Emerging Long Only Equity Fund of 2016”.

The continuing recognitions we receive for our funds is tantamount to our undivided focus on generating returns and risk management through a combination of hard work, diligence, meeting companies and industry peers all over the AFC universe, and of course superior stock selection. It is this combination that has created outstanding funds with great track records that can truly add a welcome performance boost to diversified investment portfolios, while at the same time reducing overall risk.

If you have an interest in meeting with our team during their travels, please contact Peter de Vries at pdv@asiafrontiercapital.com.

AFC Asia Frontier Fund – Manager Comment February 2017

AFC Asia Frontier Fund (AAFF) USD A-shares lost −1.1% in February 2017. The fund underperformed the MSCI Frontier Markets Asia Index (+0.8%) and the MSCI World Index (+2.6%) and the MSCI Frontier Markets Index which was down −0.4%. The performance of the AFC Asia Frontier Fund A-shares since inception on 31st March 2012 now stands at +73.8% versus the MSCI Frontier Markets Asia Index which is up +16.4% and MSCI Frontier Index (+9.2%) during the same period. The fund’s annualized performance since inception is +11.9% p.a. while its YTD performance stands at +2.0%. The fund’s annualized performance since inception is +11.9% p.a. while its YTD performance stands at +2.0%. The broad diversification of the fund’s portfolio has resulted in lower risk with an annualised volatility of 9.13%, a Sharpe ratio of 1.29 and a correlation of the fund versus the MSCI World Index USD of 0.34, all based on monthly observations since inception.

Backed by consistent performance since inception, the fund scaled a new high in terms of assets under management with a record inflow of new funds during the month taking the assets of the fund past the USD 20 million mark, closing the month at USD 22.1 million.

This was a tougher month for the fund compared to performance over the past eleven months. Following a benchmark agnostic approach has led to outperformance over the past year, as well as over the long run. However, at times this approach can impact performance as the fund only holds 5 out of the 33 companies that make up the benchmark. This was one of the reasons for underperforming this month, while two of the fund’s largest holdings also corrected somewhat, both of which are not part of the benchmark. Weakness in Pakistan did not help as there was some stress among local investors due to regulatory issues surrounding brokers.

There was no significant change in the fundamentals of the economies or the companies, but we are watching the rising current account deficit in Pakistan which could have an impact on the currency in the near term. The Pakistani Rupee has been stable over the past year and a slight depreciation cannot be ruled out. However, the economic growth story of Pakistan is still stable with rising auto sales and increased industrial production. Companies in sectors besides cement are also announcing expansion plans, i.e. auto and steel, and there has also been an increasing growth rate of consumer loans with most listed banks being quite bullish on consumer loan growth this year. This reflects the confidence in the economy at present, even though there could be some political headwinds with the elections next year. We remain positive on consumer discretionary stocks in Pakistan and have accordingly invested in companies related to this sector.

The outlook for Vietnam continues to be positive with the Purchasing Managers Index (PMI) for February coming in at 54.2, the highest level since May 2015, thus putting to rest some of the uncertainties post the election of Donald Trump given Vietnam’s exposure to manufacturing led export growth.

On 19th February Mongolia agreed to bailout terms from the IMF and other international organizations and countries totalling USD 5.5bln. By entering the IMF’s Extended Fund Facility, Mongolia will be required to maintain better fiscal discipline and conduct a review of the country’s financial services sector. This is the sixth time the IMF has bailed out Mongolia and hopefully this will mark a turnaround for the country as the timing is attractive with rising prices for commodities, in particular for copper, coal and gold.

Laos could be about to experience an abrupt positive change in its stock market. The Laos Securities Commission has announced that investors will no longer be required to pre-fund their trading accounts. This news will likely pave the way for foreign custodians to enter the market, with Bangkok Bank likely to be among the first wave. In time, we would expect this to drive liquidity and incentivize local companies to IPO as they will have access to a wider and more institutional investor base.

The best performing indexes in the AAFF universe in February were Mongolia (+5.2%), Iraq (+3.2%) and Bangladesh (+2.6%). The poorest performing markets were Cambodia (−6.4%) and Pakistan (−1.0%). The top-performing portfolio stocks this month with one exception were again from Mongolia: an oil exploration company (+62.7%), a coal mine (+51.4%), and a concrete producer (+28.3%). A Vietnamese property developer was up +22.7%.

In February, we added to existing positions in Iraq, Laos, Mongolia, and Vietnam and partially sold four Mongolian holdings.

As of 28th February 2017, the portfolio was invested in 107 companies, 1 fund and held 14.2% in cash. At this point the cash level is temporarily high due to the recently received significant net inflow. The two biggest stock positions were a pharmaceutical company in Bangladesh (8.1%) and a Pakistani pharmaceutical company (4.6%). The countries with the largest asset allocation include Pakistan (23.2%), Vietnam (23.0%) and Bangladesh (16.0%). The sectors with the largest allocation of assets are consumer goods (27.5%) and healthcare (17.7%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 19.63x, the estimated weighted average P/B ratio was 3.64x and the estimated portfolio dividend yield was 2.98%.

For more information about Asia Frontier Capital’s Asia Frontier Fund please click the following links:

AFC Iraq Fund – Manager Comment February 2017

AFC Iraq Fund Class D shares returned −0.1% in February as the market began a process of consolidation after the blistering momentum of the last few months that affirmed the start of a bull market.

The correction in the equity market, which was anticipated in last month’s update, extended into mid-February with an overall decline of about −3%, as measured by Rabee RSISX USD Index (RSISUSD). Now, the correction seems to have run its course as the index ended the month +1.5% in USD terms. The most likely scenario is an extended consolidation with an upward bias in the next few months. However, the strength of the rebound has continued to surprise which is often the case in illiquid frontier markets as observers often underestimate the intensity of a rebound. Similarly, the extent of a decline often far exceeds observers’ expectations. This year’s market, so far, is playing out as the mirror image of last year that saw a relentless decline in the index with −13.7% in January, −4.4% in February, −10.7% in March, −6.6%, in April and −11.9% in May. Liquidity is the same driver which this year witnessed an initial and gradual recovery, while last year it went through the final draining.

The revival in liquidity has been mostly from local buyers with foreigners as net sellers (see chart below), although at much lower levels than last year. While in itself an unwelcome development, the flip side of it has been the ease at which locals have absorbed this selling, especially considering that foreign selling in selected names has resulted in minor declines of −3% to −7% but these names mostly recovered as a result of local buying that seems unabated. Lower quality banks, favoured by locals and under-owned by foreign institutions, continued to outperform and benefit from local buying, accounting for the Fund’s underperformance vs. the Index.

Net Foreign activity index on the Iraq Stock Exchange (ISX) (green)

vs 10-day of avg. of net foreign activity (red)

(Source: Iraq Stock Exchange (ISX), AFC)

The recovery of the market price of the Iraqi Dinar mirrored that of the equity market. Last month the market price of Iraqi Dinar vs. the USD improved by lowering the premium over the official exchange rate to 8% from just under 10% that developed in 2016. The premium widened to 8.7% by mid-February, but has since recovered to end the month at 5.9% (see chart below).

Official IQD/USD rate (grey), Market IQD/USD rate (red),

Spread (green) RHS

(Source: Central Bank of Iraq, AFC)

The spikes in 2012, 2013 and 2015 were a result of CBI polices

that aimed to control the demand for USD but were

abandoned when they raised market prices.

However, the improvement in liquidity is still in the early phases with absolute liquidity low, as can been seen from the average daily volumes that, although at similarly elevated levels of the last few months (see chart below), are meaningfully below those of the prior years when the market was much stronger. Given that the risks of the last two years are still present, liquidity in the economy is still scarce, the recovery will likely take place in fits and starts and the opportunity continues to be to acquire attractive assets that have yet to discount a sustainable economic recovery.

Turnover index on the Iraq Stock Exchange (ISX) (green)

vs 10-day of avg. of turnover (red)

(Source: Iraq Stock Exchange (ISX), AFC)

Supporting liquidity improvements are the strength in oil prices at sustainably higher levels than those budgeted for by the government and the IMF and thus should give further impetus to the expansion in non-oil capital investment spending, estimated to be +192% YOY in 2017 after contractions of −68% in 2016 and −50% in 2015 (the importance of this investment spending for the economy was highlighted in December’s newsletter in the section for 2017 outlook which appears after the December 2016 review). The chart below continues to support the thesis that the market has significant catching up to do in the long process of discounting the end of conflict and the subsequent recovery afterwards. The recent gains, as impressive as they are, only represent a 30% retracement of the −68% decline from 2014 peak to 2016 multi-year lows (see chart below).

Rabee Securities’ RSISUSD Index (red), 200 day moving average (green)

(Source: Iraq Stock Exchange (ISX), Rabee Securities, AFC)

The last two weeks saw an acceleration in the Mosul offensive with the start of the campaign to liberate the western part of the city, which is coupled with increased US support and involvement as highlighted by the US Defence Secretary’s current visit to Iraq. While, the campaign took longer than initial expectations the important point to note is Mosul’s infrastructure, unlike other liberated areas such as Ramadi, was mostly preserved and life is returning to the city. Most inhabitants started the long process of reclaiming their lives and shedding the shackles of ISIS. While, the political future of the city and the areas is still in doubt with many competing interests jockeying for future dominance, never the less Mosul’s quick revival argues well for the future of the country post ISIS.

Parallel developments against ISIS in Syria have also been taking place, which combined with the above should accelerate the end of the ISIS occupation and bring the end of conflict in the region. As often discussed in past newsletters: long-term solutions, following the military resolution of the ISIS occupation, would involve significant investments in infrastructure to bring much-needed developments and create prosperity as a long-term resolution to the problems that led to the rise of extremism. As a confirmation of this thesis, note that it has just been reported by Reuters that the UK government arranged for USD 12.3 billion in loans to finance infrastructure projects in Iraq over a 10-year period to be undertaken by British companies. Many such announcements will most likely be made in the next following months by other countries.

As of 28th February 2017, the AFC Iraq Fund was invested in 14 names and held 0.9% in cash. The fund invests in both local and foreign listed companies that have the majority of their business activities in Iraq. The countries with the largest asset allocation were Iraq (97.8%), Norway (1.9%), and the UK (0.3%). The sectors with the largest allocation of assets were financials (58.3%) and consumer staples (22.8%). The estimated trailing median portfolio P/E ratio was 14.46x, the estimated trailing weighted average P/B ratio was 1.01x, and the estimated portfolio dividend yield was 2.03%.

For more information about Asia Frontier Capital’s Iraq Fund, please click the following links:

AFC Vietnam Fund – Manager Comment February 2017

The AFC Vietnam Fund returned +1.1% in February with an NAV of USD 1,685.37, a new all-time high, bringing the net return since inception to +68.5%. This represents an annualized return of +17.4% p.a. By comparison, the February performance of the Ho Chi Minh City VN Index was up by +1.2% while the Hanoi VH Index increased by +2.0% (in USD terms). Since inception, the AFC Vietnam Fund has outperformed the VN and VH Indices by +39.0% and +50.7% respectively (in USD terms). The broad diversification of the fund’s portfolio resulted in a low annualized volatility of 9.13%, a high Sharpe ratio of 1.81 and a low correlation of the fund versus the MSCI World Index USD of 0.30, all based on monthly observations since inception.

The upward bias in February continued after the long Tet holiday. Market sentiment was positive and both indexes in HCMC and Hanoi were up 1.9% and 2.8% respectively. All 2016 earnings announcements are finally out, and hence our main focus was the re-balancing of our portfolio according to our model, in order to optimize our allocation in undervalued companies and to be perfectly positioned in 2017. This rebalancing is now almost completed and our portfolio gained 2.0% in local currency.

Market developments

While most other Vietnam funds and also both stock market indices run a high concentration in a handful of stocks, the five biggest positions in our AFC Vietnam Fund are only about 10% of the total portfolio. With most positions ranging between 0.8% and 1.5%, the development of the broader market, as seen below with the advanced/decline ratio (A/D), is more important for us than the development of the 2 indices, since they are often influenced by special events in the few index heavyweight names.

(Source: Bloomberg / AFC)

Without looking at the index it is very clear that the performance was mainly generated during the months when the A/D ratio went up. We still believe that there is a high probability of a broader bull market, triggered by the vastly undervalued small cap segment, the low foreign investor base compared to other Asian markets and the Vietnamese gambling mentality. A prolonged rally in the broader market should trigger another leg up in our NAV, and with the latest rebound in the A/D ratio we are already starting to observe interest in several of our stocks. In fact, it is quite astonishing to see a frontier market like Vietnam trading with such a low volatility over a prolonged period of time. While most developed and developing markets were moving significantly in both directions over the past two years and daily movements of 1-3% could be seen on many occasions, a small cap index like Hanoi had barely moved at all for some time now and a daily price movement of 2% or more is a rarity.

Dow Jones/DAX/Nikkei 225/Hanoi – rebased as of 31/12/14;

(source: Bloomberg)

While fluctuations (=volatility =risk) over the past two years have totalled almost 40% for the German DAX index and not much less for other major indices, the index in Hanoi moved only by half that amount. Together with lower valuations and the recent outperformance of much more expensive markets, we see that as a perfect investment case for our stock universe looking 1-2 years ahead. We also see increased interest in our fund recently which confirms our bullish view on the market for this year.

Vietnam sees a Significant Increase in Consumer Confidence Index Q4-2016

Vietnamese consumer confidence finished 2016 on a high note, which lifted Vietnam to the fifth most optimistic country globally, with an index score of 112 (+5 points compared to the previous quarter), according to the latest Nielsen Consumer Confidence Index, an institute which studies global consumer behavioural data.

(Source: Nielsen Vietnam)

According to Nielsen, Vietnam’s sizable population with a high intellectual level and strong growth of an aspiring middle class and stable economic outlook are the main reasons why Vietnam is such an optimistic country in comparison with other nations in the region. Vietnam has a population of more than 92 million inhabitants, of which more than 60% are under 35 years old. The fast-growing middle class is pushing domestic consumption up strongly, which is an important factor driving economic growth in the foreseeable future. Nonetheless, it is interesting to note that Vietnam has one of the highest saving rates in the world.

According to the Nielsen Vietnam report, the saving rate of Vietnam lies at around 76%, the highest level in the region, followed by Indonesia (71%), Philippines (64%), Singapore (65%), Thailand (63%) and Malaysia (59%). Most likely, half of these savings will be spent for children’s education in the future.

Household saving in percentage

(Source: Nielsen Vietnam)

All of these positive factors will probably help Vietnam to become one of the more important economies, not only in Asia but also in the whole world. PWC projects that by 2050, Vietnam will rank number 20 in the world by GDP, higher than countries such as Italy, Canada, or Australia.

The fastest growing low-cost airline, Vietjet Air, lists on Ho Chi Minh Stock Exchange

On 28th February 2017, the fastest growing low-cost airline, Vietjet Air, listed a total of 300 million shares on the Ho Chi Minh City Stock Exchange. The stock price of Vietjet Air ended its first trading day at VND 108,000, over 20% higher than its official listing price of VND 90,000, which equates to a market cap of USD 1.42 billion.

Vietjet has taken Vietnam Airlines by surprise, with an almost 43% market share of the domestic aviation market as of June, 2016. In 2016, total revenue hit VND 27,532 billion equivalent to USD 1.21 billion and net profit is estimated to reach VND 2,290 billion (~USD 100.5 million) which equates to a growth rate of 38.7% and 95.6% respectively. The low-cost carrier currently trades at a P/E of 14.1x and P/B of 7.2.

(Source: AFC research, SSI, GSO, SBV, VCB)

At the end of February, the fund’s largest positions were: Agriculture Bank Insurance JSC (3.0%) – an insurance company, Sam Cuong Material Electrical and Telecom Corp (2.8%) – a manufacturer of electrical and telecom equipment, Bibica Corp (1.8%) – a packaged foods manufacturer, Vietnam Livestock Corporation JSC (1.8%) – a livestock and animal feed company, and Global Electrical Technology JSC (1.6%) – an electrical and IT equipment manufacturer.

The portfolio was invested in 81 names and held 5.4% in cash. The sectors with the largest allocation of assets were consumer goods (32.5%) and industrials (25.6%). The fund’s estimated weighted average trailing P/E ratio was 9.73x, the estimated weighted average P/B ratio was 1.56x and the estimated portfolio dividend yield was 6.80%.

For more information about Asia Frontier Capital’s Vietnam Fund please click the following links:

AFC Travel Report – Laos

In line with our process of being on the ground in the countries we invest in, Scott Osheroff, Analyst at Asia Frontier Capital, travelled to Laos to visit portfolio companies and other companies on our shortlist. The photos in this article are all by AFC.

As our group departed Bangkok for Ubon Ratchathani I was looking forward to seeing a different part of Laos than I experienced a year earlier when I visited Vientiane, the capital of Laos. Upon landing, our group of 20 or so investors assembled into a convoy of vans making the one-hour drive towards the border. When we arrived on the Thai side of the border in Chong Mek things were orderly and the infrastructure was very modern as this stretch of road is part of the ASEAN road network, thus the highways are of a first world standard. However, once we walked through a tunnel under “no man’s land” the Laos side felt like Mars.

Walking up the stairs of the tunnel and between a small metal gate we had suddenly arrived in Laos — welcomed by a dirt field which stretched to the nearest road. Being one of two non-Thais on the trip, I had to find the actual border post which was a short walk down the road in order to purchase a visa while everyone else was expedited to an air-conditioned duty free shop owned and operated by the Dao-Heuang Group, one of the largest private companies in Laos and whose coffee plantation we were off to see that afternoon.

After sorting out my visa and buying some dried fruit snacks and sampling the Dao Coffee in the duty-free shop, we got back to driving towards Pakse, the second largest city in Laos, where the highway opened up to frequent construction. Considering the old highway used to lead to a slow and monotonous drive, once completed, this will allow for the efficient flow of goods throughout southern Laos through to both Thailand and Vietnam, assisting with the country’s further interconnection in the region being it is the only landlocked country in the Mekong Sub-region.

About an hour into our drive the topography changed as we flanked a large hill with a Buddha atop it and proceeded to cross a long bridge. We had arrived at the Mekong river and across it was Pakse, which flanks its northern banks. Across the bridge was our hotel for that evening and on the left a magnificently out of place building reminiscent of a property on the Right Bank in Paris, we were told is the new home of the Vietnamese family who owns the Dao-Heuang Group. In front of their house is one of a regional chain of Dao Coffee shops. After a quick coffee in this fully modernized coffee shop and a greeting from the company’s management we set out yet again, this time to the source of the coffee, a several thousand hectare plantation owned by Dao Heuang 1.5 hours north.

View from the hotel in Pakse with Champasak Grand Hotel in the centre

Laos, being on a plateau well above sea level, is renowned for its rolling hills, lush greenery and cool weather. As we pushed northward, passing traditional villages on the same highway under seemingly perpetual construction, we transitioned consistently between pavement and gravel road, while the skies simultaneously opened up on us with a dense rainfall. Eventually, the rain cleared and the stunning mountains became visible all around us. It was obvious we were climbing higher as the topography had changed yet again and we were now well over 1,000 meters above sea level. Each mountain top was covered in a misty haze as we got closer to the plantation. Upon arriving at the plantation, we were given a quick tour of the on-site facilities where the coffee beans are separated from the fruits, as well as a building constructed for a previous visit by Thai Royalty which overlooks a river running through the property. With a slight chill in the air (rare for the rest of Southeast Asia) we proceeded to the plantation itself where we were educated about the varieties of coffee grown, and the company’s good agricultural practices. The plantation stretched as far as the eye could see in every direction with large trees creating a canopy to provide shade to the coffee. It was beautiful to say the least.

Freshly hulled coffee beans being loaded for transport to the drying facility.

The following morning, we woke up early to visit Dao-Heuang’s USD 120 million processing facilities just north of Pakse. This is the heart of their processing operations where they roast and export the internationally competitive coffee we saw the day before to Japan, Thailand and Europe, produce some of the highest quality fruit chips on the regional market, as well as produce bottled water which has a ~30% domestic market share. All of their machinery is imported from Western countries and as the per capita income of the average Laotian rises, they are selling more of their products domestically. A highly encouraging story with the potential for multiple IPO’s of subsidiary companies, we are patiently waiting for Dao-Heuang to advance towards an IPO on the Laos Stock Exchange (LSX).

Several hectares of coffee sun drying

One of several water bottling production lines

Another company which is already listed on the LSX is EDL Generation Company (EDL Gen). A national symbol for the country branded as the “Battery of Asia,” EDL Gen is a partially privatized State Owned Enterprise (SOE) which is the largest domestic producer of electricity. EDL Gen has several dozen run-of-the-river hydropower dams with a target to reach approximately 100 by 2020, as well as expanding into other renewables such as solar and wind (in fact, earlier this year EDL Gen inaugurated Laos’ first solar power plant capable of generating 3MW of electricity). Run-of-the-river hydro projects tend to be much more environmentally friendly than traditional dams which create large reservoirs by flooding the areas behind the dams. With quasi-monopoly status in electricity generation, all of the power generated by the company is either sold to EDL, the state-owned electricity distribution company, or exported to neighbouring countries

With a small population of nearly 7 million, Laos is relying on its water resources, among others, to become a regional supplier of commodities. This has seen EDL Gen focus on becoming a regional supplier of green energy to its neighbours—China, Vietnam, Cambodia, Thailand and Myanmar—creating a stable and high quality source of foreign exchange.

After a two-hour drive from Dao’s processing facilities, we arrived at EDL Gen’s 76MW Xeset 2 dam where we received a presentation from management followed by a free exploration of the dam site and its turbines which are manufactured by ABB. Walking down into the heart of the dam you could feel the intensity of the turbines as they churned water into green energy. This being a run-of-the-river hydro project it is a three-tiered dam, thus we started at the lowest dam and continued up the mountain behind to reach the next two projects.

EDL Gen’s Xeset 2 dam

As our tour came to an end it was getting late in the day. With the Thai border set to close around sunset we wrapped up our dam site visit and raced back to the border post which we had entered the day prior. Arriving just in time, I stamped out of Laos by myself and took a quiet stroll in the pitch-black of night across no-man’s land finding my way to the Thai border checkpoint as it would take me longer to pass immigration than my Thai counterparts.

The evening concluded back in Ubon Ratchathani at our hotel buttressing up against a river bank where we were able to reflect on Laos and its budding potential as the Mekong sub-region becomes increasingly interconnected and wealthy. Laos is often overlooked as an investment opportunity, however, with the government recently passing legislation which should see international custodians enter the market and with several more potential IPO’s in the pipeline, it seems this landlocked country will increasingly move out of its slumber and continue to integrate into the fast-paced world which surrounds it.

Sorry, comments are closed for this post.