“In investing, what is comfortable is rarely profitable.”

– Robert Arnott, Research Affiliates

|

AFC Funds Performance Summary

The Brexit surprise in late June caused a period of volatility in worldwide equity markets which was followed by a rebound in July with US markets posting significant gains, while most European markets recovered somewhat but are still trading below pre-Brexit levels. Interestingly, Japan, emerging markets, and frontier markets in Asia have benefited and they rallied to higher levels than before Brexit. The AFC Asia Frontier Fund has recorded 5 months of positive performance in a row and is now up +8.9% so far this year in USD terms while the MSCI World Index is up just +3.5%. The AFC Vietnam Fund, gained +3.0% in July, its 6th consecutive positive month and is now up +18.2% YTD, outperforming its benchmark, the Ho Chi Minh City Index, which is up by +13.6%. The funds keep outperforming their benchmarks, especially in negative months, and also often in positive months, resulting in an outperformance since inception on an annualized basis of +7.3% for the AFC Asia Frontier Fund and +7.5% for the AFC Vietnam Fund, both in USD terms. This performance confirms the validity of our strategy. It also results in repeatedly receiving recognition for our efforts. We won two TOP-10 awards from Barclay Hedge for the performance of the AFC Vietnam Fund in June 2016, one for its performance in the Emerging Markets Asia Sector, and the other for the Emerging Markets Equity – Asia Sector. We also won in the Global Fund Awards 2016, which recognized our regional fund as “Asian Frontier Fund of the Year”.

The awards are important to us as they confirm that our efforts are worthwhile. The AFC Asia Frontier Fund and the AFC Vietnam Fund have now been awarded the Barclay Hedge TOP 10 awards a total of 15 times, which shows that our ability to perform, not only in the geographical scope of both funds, but also in a much broader area, i.e. the Asia Pacific Region ex-Japan is continuing, and over time, a regular appearance in the TOP 10 makes for top performing funds. One of the contributing factors to such performance is prudent risk management. In our view, risk management is at least as important, if not more so, than our ability to identify great investment opportunities. We manage our funds’ risks by performing a solid analysis of the macro economic factors playing a role in each country that we invest, which will drive the allocation strategy to the countries in our universe. Also, we thoroughly research each company that we invest in for the risks that it is exposed to. Then we carefully size our positions so that the overall impact of any one negative surprise would be very much muted. But as the quote at the top of this newsletter already indicates, some risk is necessary. It is the proper management of risks, which over time can result in an outstanding overall performance. This past month we have again experienced a significant investor interest in our AFC Vietnam Fund, resulting in a large number of new subscriptions. The fund’s AUM now stands at USD 29 million, bringing the firm’s AUM to USD 45 million. Second AFC Vietnam Investor TourAs mentioned last month, AFC will hold the second investor tour to Vietnam from 26th March – 2nd April 2017, which will provide valuable insights about investing in frontier markets and in Vietnam in particular while enjoying interesting sights and relaxation during some extra time before and after the meat of the tour. The tour will take us to several business centres and a few tourist spots. In Hanoi we will stay at the Sofitel and we will have several factory visits there on the 27th and 28th of March and also go to see the Hanoi Stock Exchange. In Ho Chi Minh City we will have a number of presentations by industry experts, and visit several other companies from various industries on the 29th – 31st of March. There is also time for recreation and the 26th of March as well as the 1st and 2nd of April are set aside for touristic activities as well as for a few more optional site visits. If you are interested in learning more about this tour, please send an email to Thomas Hugger, email: th@asiafrontiercapital.com so we can send you detailed information and sign up details. On another note, there is a conference organized by Hubbis titled “The Vietnam Wealth Management Forum 2016” which will be held on the 8th of September, 2016 at the Park Hyatt Saigon at which our AFC Vietnam Fund CEO Andreas Vogelsanger will be speaking. For more information click: the Vietnam Wealth Management Forum 2016 If you are interested in participating in this conference, please send an email to Peter de Vries, email: pdv@asiafrontiercapital.com so we can arrange a complimentary ticket for you. Our contributing editor John Enos just returned from his journey to two frontier countries (where we don’t invest): Kazakhstan & Kyrgyzstan. We close this month’s newsletter with the first of a three-part series of articles in which he recounts his interesting experiences during this exciting trip. AFC in the Press

Upcoming AFC TravelIf you have an interest in meeting with our team during their travels, please contact Peter de Vries at pdv@asiafrontiercapital.com.

AFC Asia Frontier Fund – Manager Comment July 2016

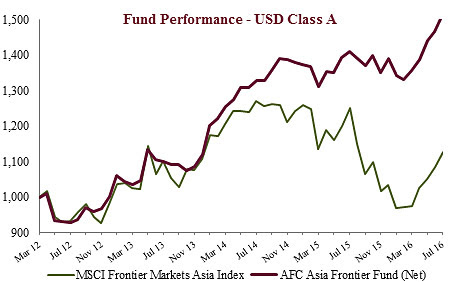

AFC Asia Frontier Fund (AAFF) USD A-shares gained +3.2% in July 2016 bringing the year to date performance to +8.9%. The fund underperformed the MSCI Frontier Markets Asia Index (+3.9%) and the MSCI World Index (+4.1%) this month but outperformed the MSCI Frontier Markets Index (+1.0%). The USD A shares achieved an NAV of USD 1,514.42 which is a new all-time high (the previous high was in June 2016 with USD 1,467.65). The performance of the AFC Asia Frontier Fund A-shares since inception on 31st March 2012 now stands at +51.4% versus the MSCI Frontier Markets Asia Index which is up +12.6% and the MSCI Frontier Index (+1.7%) during the same time period. The fund’s annualized performance since inception is +10.1%. Global markets recovered during the month after the initial panic over Brexit and frontier markets in Asia were no exception. Though emerging and frontier markets have done well this year after a dismal 2015, frontier markets in Asia are still relatively cheaper than Asian emerging markets with markets such as Pakistan and Vietnam trading at P/Es of 11.0x and 15.0x on a trailing twelve-month basis, which is still cheaper than most emerging Asian markets and many of the stocks the fund holds trade at lower valuations than their respective country multiples. Performance during the month was led by Pakistan and Vietnam, where we saw positive moves in the fund’s larger holdings in these two countries. Positive contributors to performance in Pakistan were a pharmaceutical company, two cement companies, a passenger car company and a hospital company. In Vietnam, positive performance was led by two infrastructure related companies which have also declared good results for the latest quarter. Bangladesh was unfortunately in the news for the wrong reasons due to the attack which took place in Dhaka on 1st of July. The macro outlook for Bangladesh remains stable and we like the consumer story there given a large population (156 million people most of whom are young) and rising disposable incomes. However, we hope the government does not let the extremist elements gain traction as this could upset foreign direct investment into the country which it needs to develop its export focused garment industry further. The fund underperformed the benchmark slightly due to a rally in a few Pakistani banks and a Vietnamese bank which are part of the benchmark as the fund currently does not hold any banks in Pakistan or Vietnam. Further, a tobacco company in Sri Lanka which the fund holds and is part of the benchmark saw a correction possibly due to worries over further taxation on the legal tobacco industry in Sri Lanka. Government policies over taxes have been very uncertain over the past year and this has impacted investor sentiment in Sri Lanka. The best performing indexes in the AAFF universe in July were Iraq with (+5.0%), Pakistan (+4.6%) and Mongolia with (+4.0%). The poorest performing markets were Laos with (−3.4%) and Cambodia (−1.4%). The top-performing portfolio stocks were a Mongolian construction material company (+44.5%), followed by a Pakistani car assembler (+26.3%), a Cambodia junior gold mining company which received a takeover offer (+22.6%), and a Mongolian bread and pastry producer (+17.6%). In July we added to existing positions in Cambodia, Mongolia, Papua New Guinea and Vietnam and we reduced our existing holding in a Sri Lankan company. We completely exited three Sri Lankan companies from the retail, cement and holding sectors. As of 31st July 2016, the portfolio was invested in 93 companies, 1 fund and held 6.5% in cash. The two biggest stock positions were a pharmaceutical company in Bangladesh (6.1%) and a Pakistani pharmaceutical company (5.9%). The countries with the largest asset allocation include Vietnam (30.7%), Pakistan (24.4%) and Bangladesh (15.2%). The sectors with the largest allocation of assets are consumer goods (35.3%) and healthcare (19.4%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 17.49x, the estimated weighted average P/B ratio was 1.42x and the estimated portfolio dividend yield was 2.75%. For more information about Asia Frontier Capital’s Asia Frontier Fund please click the following links: Factsheet AFC Asia Frontier Fund – July 2016 AFC Iraq Fund Manager Comment July 2016

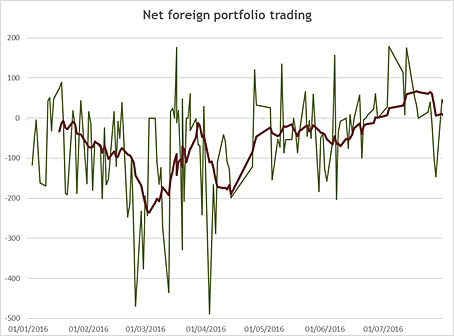

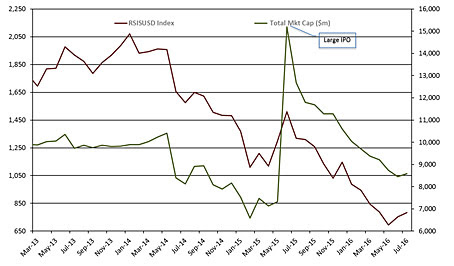

AFC Iraq Fund Class D shares returned −1.9% in July 2016 with an NAV of USD 587.14, an underperformance of −6.0% vs. the Rabee RSISX USD Index (RSISUSD) which returned +4.1% in USD terms. The fund has outperformed the RSISUSD by +7.6% year to date and +5.5% since inception. July was a frustrating month for professional fund managers in Iraq since the market was driven by retail investors and concentrated in retail favourites such as the hotel group, low quality stocks and, as usual during this time of the year, dividend payment stories with the limited available liquidity moving from name to name. Moreover, the market was closed for almost half of July due to the Eid holidays and days off due to excessive summer heat with the result that demand for USD was mostly unmet which led to a decline of −1.4% in the IQD versus the USD. The combination accounted for about +4% of the above performance differential for July. This disparity has narrowed since the worst point of the month and should reverse in the course of the next few months. This disparity has happened in December of last year during which the index returned +11.1% vs +0.6% for the fund and as noted then “Although the index is a reasonable representation of the largest and most actively traded segment of the market at a specific point in time, it never the less is at odds with the aim of a long term portfolio. The upshot is likely wide disparity between the index and the fund in any given month but over the long term a delta between the two should emerge and give a more meaningful measure of performance”. This long term delta, although admittedly the fund is still young, has developed over the following months with the Fund ahead of the index for the first six months of 2016 by +11.8% and even after a disappointing July by +7.6% YTD. The disparity does not take away from the improved local sentiment and from the changed liquidity profile of the equity market from negative, less negative to almost neutral with the turnaround in foreign outflows. Foreigners were marginal net buyers reversing the selling that dominated 2016. However, it is more of a function of an absence/exhaustion of selling as opposed to any significant new foreign buying. Consider the chart below of net foreign investor activity excluding actions of strategic owners or insiders: Daily index of net foreign portfolio inflow green and The performance of Iraq’s internationally traded USD Bond still supports the thesis argued here last month that, as it is internationally & institutionally traded and thus free from the liquidity constraints of the local market, fixed income institutional investors are buying into the Iraq story (see the chart below). With the positive inflows into emerging markets & down the road into frontier markets imply that foreign inflows into Iraq should gradually materialize as the progress in the war against ISIS mitigates the Iraq risk aversion. The Iraqi market (Rabee USD Equity Index) vs. Brent crude vs Iraq’s Bond Although local sentiment has shifted materially, the local liquidity crisis is still in force, as it will take time for foreign aid and higher government revenues to filter into the wider economy, but it is shifting from getting worse into not getting worse and into neutral. The main takeaway is that the accelerated decline is showing signs of coming to an end with the combination of substantial foreign aid, higher government revenues from higher oil prices and benefitting from the significantly lower military expenditure over the horizon with the end of the ISIS war should make begin the process of ending the liquidity crises and will ultimately liquefy the economy. To put the decline of the market over the last two years in perspective, Moody’s noted following the USD 5.4 bn IMF standby agreement “In 2015, year-over-year net foreign direct investment inflows declined by 30% to USD 3.2 bn, & net portfolio inflows dropped by 86% to about USD 630 m. Net other investment outflows nearly doubled to about USD 8.5 bn”. While the definition used here of portfolio inflows encompasses a wider universe that the equity market, nevertheless, the scale of the net outflows plus the collapse in oil prices had a dramatic negative effect on local liquidity. In hindsight it was not a surprise that equity markets saw a decline of 62% in from the January 2014 peak to date. The Iraqi market (Rabee USD Equity Index) vs. Total market Capitalization Conversely, the end of these outflows & the expected turn-around in local liquidity should have a positive effect on the economy and eventually to the equity market to be played out over the next few months. Current levels, within this environment, continue to be exceptionally attractive to acquire quality assets that are still discounting all negatives and none of the potential positives with the market. The military momentum established with the capture of Fallujah has continued with the government declaring the complete liberation of the Anbar province, in which Fallujah and Ramadi are its main cities, and for the last 2 years pretty much overran by ISIS. Preparations for the liberation of Mosul are intensifying with continued advances by the Iraqi army and the Kurdish Peshmerga tightening the noose around the city with reports emerging of escapes of senior ISIS members with their families like the rats escaping a sinking ship. We still maintain the view expressed many times in the past that the ISIS caliphate will fall from within. There has been a significant shift in focus of Iraq’s sponsors from the fight against ISIS to after ISIS and the reconstruction of liberated territories to secure the peace. In a recent conference USD 2.1bn in aid was pledged for the relief and stabilization in the aftermath of the expected liberation of Mosul which ultimately will herald significant investments in infrastructure and in the process create and foster prosperity to defeat extremism and cement the end of conflict. It is worth noting that the recent sell off in oil prices, as meaningful as it might seem, does not the change the fundamental turn-around from an over-supplied market over the last two years to a balanced market by end of this year and long term an undersupplied market. This rebalancing process takes a number of months to unfold, but it seemed to accelerate by a few temporary one-off supply disruptions such as forest fires in Canada, terror attacks in Nigeria and violence in Libya. The market got ahead of itself in extrapolating these events just as their dissipation gives the impression that the market is over-supplied. Moreover, this decline seems a minor one if seen within the context of a bottoming process after a 5-year bear market for commodities, emerging and frontier markets that is argued here recently which the chart below clearly shows Copper, Iron Ore, Brent Crude, MSCI EM & FM indices rebased to 2011 As of 31st July 2016, the AFC Iraq Fund was invested in 14 names and held 3.6% in cash. As the fund invests in both local and foreign listed companies that have the majority of their business activities in Iraq, the countries with the largest asset allocation were Iraq (94.5%), Norway (4.5%), and the UK (1.0%). The sectors with the largest allocation of assets were financials (54.4%) and consumer staples (21.9%). The estimated trailing median portfolio P/E ratio was 11.5x, the estimated trailing weighted average P/B ratio was 0.73x, and the estimated portfolio dividend yield was 1.95%. For more information about Asia Frontier Capital’s Iraq Fund, please click the following links: Factsheet AFC Iraq Fund – July 2016 AFC Vietnam Fund – Manager Comment July 2016

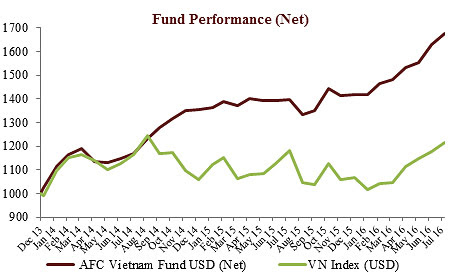

To read this month’s fund update in German please click here. The AFC Vietnam Fund gained +3.0% in July to a reach new high NAV of USD 1,677.63, bringing the year to date net return to +18.2% and the net return since inception to +67.8% or +21.4% annualized. By comparison, the July performance of the Ho Chi Minh City VN Index was up +3.2% while the Hanoi VH Index decreased by −1.2% (in USD terms). Since inception, the AFC Vietnam Fund has outperformed the VN and VH Indices by +46.4% and +51.7% respectively (in USD terms). After the sharp rise in the month of June and the first week of July, it didn’t take long until we saw a market correction. The increase in the HCMC index was due to only two stocks, while many stocks were trading down sharply, though what can be described as a healthy consolidation. After all, the Hanoi index lost 6% from the early July peak, closing the month at -1.2%, while the index in HCMC, because of the special movements of two shares, increased by +3.2%. It is therefore not surprising that this month the fund trailed the HCMC index somewhat. At the same time the fund outperformed the Hanoi index significantly. The topic of the month was certainly the abolition of the foreign ownership limit restriction of Vinamilk, which was probably the most sought after share in recent years. Ahead of this event, domestic investors pushed the stock up to a high of +29% YTD (+16% in July alone). When foreigners were finally able to buy the stock, counter to expectations, the market didn’t rise much further, and instead, a broad market correction started. The table below with the 10 highest weighted shares in the HCMC index shows the impact of these peculiar movements and in consequence how distorted the market dynamic can be:

Such peculiar movements will certainly happen again, but it will not influence our long term goal to offer our investors a portfolio with attractively valued shares which continue to perform strongly over the medium and longer term. Larger funds, which are often track the main index closely, must have enjoyed the performance of this handful of index stocks, but given that these shares are trading now at a PE of over 20x, we wonder how much the appreciation potential there will be in the long run besides their earnings growth. We continue to see the main potential in revaluation of much cheaper companies although we still hold Vinamilk as well. AFC Vietnam Fund and HCMC Index and Hanoi Index – In the past two weeks around 2/3 of portfolio companies have reported their half-year results and since some of these stocks performed extraordinary well over the past 7 months, we rebalanced the portfolio in recent days somewhat according to our model. We added 4 new promising companies and reduced a few other positions significantly. A perfect example of what we are expecting in Vietnam to happen on a larger scale, is a building materials company which we bought at the inception of the fund and sold near its peak a few weeks ago. The stock since then corrected sharply, but reported excellent results (about 40% profit growth in 2016), and with a trailing PE of about 10x, the company looks attractively valued again and we therefore bought it back a few days ago. Stock Chart Binh Duong Minerals There is relatively little to report on the macroeconomic front. Inflation seems to be manageable at currently 2.4% and the trade balance shows, to most people’s surprise, a surplus of USD 1.8 billion for the period of January to July. Given that a big part of the strong FDI (Foreign Direct Investment) was targeted to the manufacturing sector, one has to expect a high level of imports of machinery in the second half of the year, which might bring down this surplus again. FDI sharply increased by +46.9% in regards to new registrations and +15.5% based on disbursements. It proved that foreign investors continue to choose Vietnam as a good destination for their investments. Instead of investing into the real estate sector like during the last cycle, in the first half of 2016 more than 70% of FDI was poured into the industrial sector which is expected to boost the Vietnamese economy in the future. According to currently available earnings results, we expect an average P/E of 9x for the fund’s portfolio in 2016. Despite the nice gains since the beginning of the year, the upside potential remains unchanged, with a revaluation of Vietnam to international earnings valuation of around 15 – 17 times. A long term analysis of India found an interesting conclusion in investing in low P/E stocks versus more expensively priced stocks. We have already seen similar performance differences in Vietnam in the past. With a median P/E ratio of 6.5 at the inception of our fund and currently a still inexpensive valuation of around 9 for 2016, we should obviously continue to see the benefits of the ongoing re-pricing in the future. After only 2 ½ years, the fund’s assets under management have increased from an initial USD 3.7 million to over USD 29 million, due to the fund’s performance and the increased investor demand (we received a record number of subscriptions in the month of July). With our strategy of having a very broad diversification in attractively valued companies, as compared to the conventional high concentration in individual big cap stocks, we are very confident that we will continue to deliver strong results in the future despite strong growth. The portfolio was invested in 90 names and held 7.9% in cash. The sectors with the largest allocation of assets were consumer goods (33.1%) and industrials (23.9%). The fund’s estimated weighted average trailing P/E ratio was 8.76x, the estimated weighted average P/B ratio was 1.20x and the estimated portfolio dividend yield was 5.22%. At the end of July, the fund’s largest positions were: Sam Cuong Material Electrical and Telecom Corp (2.6%) – a manufacturer of electrical and telecom equipment, Bao Viet Securities JSC (2.2%) – a securities brokerage company, Global Electrical Technology JSC (2.1%) – an electrical equipment manufacturer, Nui Nho Stone JSC (1.7%) – a stone mining company, and Doan Xa Port (1.7%) – a port operator. For more information about Asia Frontier Capital’s Vietnam Fund please click the following links: Factsheet AFC Vietnam Fund – July 2016 AFC Travel Report – Kazakhstan / KyrgyzstanThis is the first of three reports by AFC contributing writer John Enos, who recently spent two months traveling by bicycle, train, and bus across Central Asia from Almaty to Ashgabat. Feel free to reach out to him at john.a.enos@gmail.com. Photos are all by John Enos. I really had no idea what to expect as I boarded my Air Astana flight direct from Bangkok to Almaty. What types of passengers would be taking this flight? Thai oil & gas businessmen? Expat mining executives returning to the steppe from a weekend of debauchery in Pattaya? Russian oligarchs looking to disappear for a while? Well, my flight was only about half full, but it was almost entirely Kazakhs – old retirees, families clad head to toe in “I Love Thailand” regalia, and young honeymooners with their arms weighed down with Gucci and Louis Vuitton shopping bags. I was immediately struck by the diversity of the passengers carrying the bright blue Kazakhstan passports – there were beautiful women and hardy men with the sculpted Kazakh features of the Steppe, there were passengers who could have passed for Thai, or Iranian, or Chinese, and most surprisingly, there were blonde haired and blue eyed Kazakhs (ethnically Russian, but now Kazakh by passport). Vladimir Putin famously said in a 2005 state of the nation address that “the collapse of the Soviet Union was one of the greatest geopolitical tragedies of the 20th century…tens of millions of our co-citizens and co-patriots found themselves outside Russian territory.” I certainly stood out as the sole scruffy, unshaven American with a one-way ticket to Almaty. Taking a cue from the gruff Kazakh sitting next to me, I ordered a shot of vodka with my lunch at 11 am. This “shot” was in fact a full glass of vodka served neat…no ice, no mixer. Little did I know this would be a strong indicator of what was to come. Vodka is ubiquitous across Central Asia, a remnant of Soviet rule. It is also dirt cheap in every country we visited, and the rates of alcoholism and liver disease are disturbingly high. As I struggled to finish my Thai-Kazakh lunch of som tam papaya salad, mystery meat sausage sandwich, and unfortunately large glass of vodka, I decided I’d spend a good portion of the remaining 6-hour flight trying to muster the basics of reading the Cyrillic alphabet. As my Dad had pointed out, learning to read Cyrillic (the alphabet used in Russian, Mongolian, and Kazakh, among other languages) is a bit like doing Sudoku or cracking a code, and one can learn most of the basics in a few hours. Cyrillic has 33 letters, and many of the letters are the same as the Latin alphabet which we use in English. The letters A – E – K – M – O – T are pronounced the same in Cyrillic. Here’s where it gets confusing: the letters В – Н – Р – С – Y – Х look the same but have totally different meanings. Then there are plenty of new letters, some of which come from the Greek alphabet, and some of which don’t, like Б – Д – И – Й – Л– Ф – Ц. I picked up the basics and began trying to decode the city destination names on the Air Astana in-flight magazine map. This entertained me for a while, and before I knew it, I was descending into the empty and beautiful steppe on the outskirts of Almaty. Welcome to Казахстан! Most people know nothing about Kazakhstan except for the satirical movie Borat, which is supposed to be set there (in fact, it was filmed in a Romanian village and there is nothing Kazakh about it…). Kazakhstan is the 9th largest country in the world (2.7 million km2), but has a population of just under 18 million people. It is incredibly sparsely populated, and in the central and western parts of the country, vast swathes of the steppe and desert stretch for miles with hardly a road or human in sight. The Kazakhs, like many of the people in Central Asia, are fiercely proud of their nomadic history and one still sees evidence of this today. Horse is the preferred meat of choice, yurts dot the green summer pastures, and an old national proverb states simply, “fast horses and fierce eagles are the wings of the Kazakh people”. Eagle hunting is still a revered sport (and art) in much of the region.

Despite our guidebook’s warnings that Kazakhstan had become a pricy destination due to its oil & gas wealth, we had picked the perfect time to make a trip. The Kazakh tenge was one of the world’s worst performing currencies in 2015 and fell nearly 50% against the dollar in less than six months starting from mid-August. In August, the Kazakh central bank had accelerated the currency’s freefall by moving to a floating exchange rate due to crashing crude prices and devaluations by neighbouring Russia and China that increased the cost of defending the tenge. Our guidebook, written in 2013, stated the exchange rate as 150 KZT per 1 USD. As I am writing this, the rate is 352 KZT per 1 USD. Even Air Astana’s website couldn’t keep up to date with the rapidly plunging tenge – when I searched their website for the bicycle luggage fee, it stated the fee was 10,000 KZT or 50 EUR. At the time of publishing it on their website, the two were the same amount. Today, 10,000 KZT is USD 28, and 50 EUR is 56 USD. Plenty of currency arbitrage opportunities exist for those with access to US dollars and bit of imagination! We found our currency arbitrage to be limited to swanky Georgian restaurants (suddenly cheap!) and Kazakh draft beer of various qualities which seemed to never cost more than $0.60 a pint. Transport, meals, drinks, taxis, admission tickets, rides on the Almaty metro – everything was fabulously affordable. Almaty was a very pleasant city, and we ended up spending six days there as we waited for my friend’s bicycle to arrive – it had been lost in transit on his flight from Uganda to Kazakhstan, much to nobody’s surprise. Almaty was my first taste of a former Soviet city, and while some of the city’s grey and concrete Stalinist architecture left a lot to be desired, as a whole it is surprisingly cosmopolitan and we had arrived just in time for the warmer summer weather. The coffee roasting baristas and iPhone-carrying Kazakhs dining at sidewalk cafes made Almaty seem very European. Although Uber just launched in Almaty last month, it wasn’t around in May when we visited. What I found far more bizarre was that a city as developed and relatively middle-income as Almaty seemed to have no registered or licensed taxis – everyone relied on gypsy cabs. If you want a ride anywhere in Almaty, you just flag down a random car driving by, give your destination, haggle over price, and jump in. Usually there are several other co-passengers also inside. You can imagine that when you speak zero Russian and zero Kazakh, negotiating and organizing rides with gypsy cabs is comically difficult. Even when we tried to point out our destination on our smartphones, Google maps would switch back and forth from Russian to English and the driver would have no idea where we were trying to go. We spent lots of time cruising around in the backseats of random guys’ cars, laughing at the uncertainty of where we would eventually end up. After six days in Almaty of exploring, eating, drinking, and making the most of the weak tenge, my friend’s bicycle showed up on our doorstep and we set off southeast towards the Kazakh-Kyrgyz border and the imposing Tian Shan mountains, one of the largest mountain ranges in the world stretching across China, Kazakhstan, Kyrgyzstan, and Uzbekistan. To make up for the lost time waiting, we hired a van to carry us and our bikes to the ramshackle town of Kegen, Kazakhstan. After a delicious bowl of Korean-style beef noodle soup (there are many second and third generation Koreans across Central Asia), we set off on bicycle to pedal into Kyrgyzstan.

The day’s ride was incredible. We crossed stunning green pastures with nothing but yurts and mountains as far as the eye could see. We encountered a pair of suspicious Kazakh border patrolmen towering over us on horseback, who grunted and pointed us towards the border crossing. We saw huge birds of prey, enormous snow-capped mountains, and the dramatic silence of the steppe – it was only every half hour or hour that a car would pass us. The highlight of the ride to the border was being greeted with a hearty “As-Salaam Alaykum” by a fierce but jolly sheep herder who was riding a formidable mustang sans saddle, with a cigarette in one hand and a vicious looking whip in the other that he used to herd his flock.

We reached the Kazakh-Kyrgyz border crossing in mid-afternoon – certainly the most spectacular and remote border I’ve ever crossed. The guards on both sides seemed quite amused to encounter three unshaven Americans in spandex biking shorts hauling 20 kilos of gear each. There were no bribes or nuisance – the guards just wanted to know if I had been to Afghanistan and had any drugs. Convinced that I wasn’t a mule smuggling heroin out of the Hindu Kush, the guards stamped me out of Kazakhstan and I continued into the most vowel-challenged country on earth, Kyrgyzstan. Kyrgyzstan has been affectionately dubbed the “Switzerland of Central Asia” due to its Alpine scenery, world-famous chocolate, and banking secrecy. Just kidding about the latter two, but the scenery is stunning and the mountains splendid. To distinguish itself from the notoriously bureaucratic and labyrinthine visa procedures that plague most of the “Stans”, Kyrgyzstan has introduced a free 60-day visa on arrival for dozens of countries in an effort to boost tourism.

Perhaps due to its challenging and rugged environment, Kyrgyzstan’s population is small (5.7 million) and also quite sparsely populated. We set out on our bikes for the southern shore of Issyk Kul, which is the world’s second largest saline lake after the Caspian Sea and the second largest mountain lake in the world after Lake Titicaca. It was also used as a torpedo test site by the Soviet navy, even though today its main draw is its beach resorts for wealthy urbanites coming from Almaty or Bishkek. The southern shore draws some adventurous tourists interested in trekking into the Tian Shan mountains, but apart from the occasional rugged backpacker or climber, we didn’t meet many non-Kyrgyz in the small villages we cycled through.

Our first night in Kyrgyzstan as we headed for the lake’s shores was by far our most memorable. Living near the equator, I had forgotten how late it stays light in the northern hemisphere, and at 8:30 pm we found ourselves still cycling through the middle of nowhere, Kyrgyzstan, chasing daylight and realizing that although we had a tent and some food provisions, we had no fuel for our camping stove and the temperature was starting to drop quickly. After unsuccessfully trying to ask for gasoline using a few Russian/Kazakh/Kyrgyz words from our guidebook, we were getting desperate and cycled up to the closest house we could find. The looks on the faces of the Kyrgyz family we encountered were something I can’t describe. We were almost delusional from exhaustion, hunger, and cold, and must have looked a bit insane as we tried to use charades to explain that we would like to use their stove to cook and would also appreciate camping on their living room floor. Devoid of English but full of hospitality, the entire Kyrgyz family welcomed us in and stared in amusement as I pulled out my Leatherman camping knife and began chopping sausage into the pasta we boiled. The whole family came to have a look at us, including the weathered old grandpa who initially seemed annoyed by our presence but warmed to us when he saw our sturdy steel bikes and our appreciation of his family’s fine horses, hot tea, and color television.

The next week was a beautiful blur of stunning landscapes, flat tires, extremely sore quadriceps, and a few hundred kilometres cycled as we navigated the southern shore of Lake Issyk Kul and finally arrived in Bishkek, the small but cosmopolitan capital of Kyrgyzstan.

The Kyrgyz Stock Exchange, pictured above, opened in 1995 and celebrated its 20 year anniversary in 2015. Over the life of the exchange, the index has increased from 100 to 428, with a market cap of USD 221 million or 14,906 million Som. It lists equities and bonds. The Exchange is in Bishkek, and more info can be found at www.kse.kg. To be continued in next month’s newsletter… |

Sorry, comments are closed for this post.