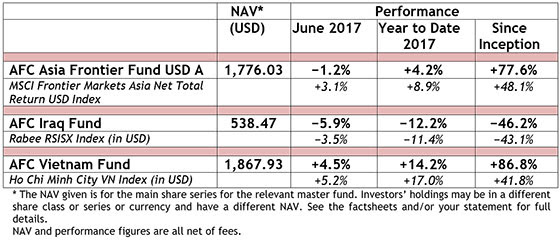

AFC Funds Performance Summary

Rallies in frontier markets and emerging markets continued in June 2017 as the MSCI Frontier Markets Asia Net Total Return USD Index added +3.1%, while the global MSCI Frontier Markets Net Total Return USD Index returned +0.6% and the MSCI Emerging Markets Index Net Total Return Index rallied +1.0%. Worldwide, developed markets also rallied with the MSCI World Net Total Return Index gaining +0.4%. Europe disappointed this month as the Euro Stoxx 50 Index lost −3.2% for the month.

The AFC Asia Frontier Fund lost −1.4% in June, underperforming the MSCI Frontier Markets Asia Net Total Return USD Index as a result of profit taking in Pakistan, in the wake of the inclusion of the country into the MSCI Emerging Markets Index, as well as due to certain political issues. Weakness in Mongolia due to the unexpected results in the presidential elections that were held on the 26th of June also did not help performance. More details can be found in the AFC Asia Frontier Fund manager comment below. The fund is now up +77.6% since inception, which corresponds to an annualized return of +11.6% p.a.

The AFC Iraq Fund continued its correction and lost −5.9% in June. Its performance year-to-date is −12.2%.

The AFC Vietnam Fund rose +4.5% in June compared with the VN-Index in USD terms which rose +5.2 as the Vietnamese markets continued their rally which was led by the banks. The fund is now up +86.8% since inception, which corresponds to an annualized return of +19.4% p.a.

AFC Vietnam Fund wins 2 BarclayHedge Awards

BarclayHedge graced us with two TOP 10 awards for the May 2017 performance of the AFC Vietnam Fund in the categories “Emerging Markets – Asia” and “Emerging Markets Equity – Asia”. These awards are for monthly returns, and are of course encouraging in the pursuit of long term attractive returns, which the fund has also shown. It is interesting to note that we received the same TOP 10 awards for calendar year 2016 as well. The quantitative fundamental strategy of the AFC Vietnam Fund has proven yet again to be able to provide superb returns at a low volatility and it is this dynamic that we expect to see continuing going forward as well. In Citywire’s ranking of Vietnam funds in the category Emerging Market – Asia, the AFC Vietnam Fund is #2 for its 3-year performance, with a small gap to fill to get to the top spot, but with a remarkable difference in volatility. Both in terms of standard deviation and maximum drawdown, the fund is ranked #1 and the top contender on the list (in terms of performance has a standard deviation and a maximum drawdown that is 75%+ higher than that of the AFC Vietnam Fund). The strength of our AFC Vietnam Fund lies in achieving strong and sustainable risk adjusted returns.

AFC in the Press

| 04-07-2017 | Iraq Business News: A review of the Iraqi Equity Market for June |

| 19-06-2017 | Citywire: AAA-rated star mines golden frontier opportunity |

Upcoming AFC Travel

If you have an interest in meeting with our team during their travels, please contact Peter de Vries at pdv@asiafrontiercapital.com.

AFC Asia Frontier Fund – Manager Comment June 2017

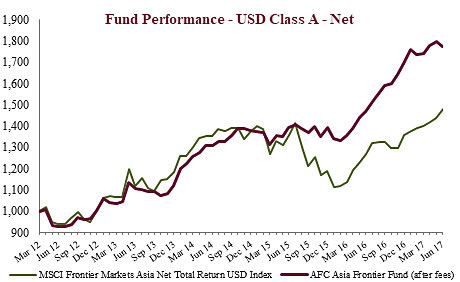

AFC Asia Frontier Fund (AAFF) USD A-shares lost −1.2% in June 2017. The fund underperformed the MSCI Frontier Markets Asia Net Total Return USD Index (+3.1%), the MSCI Frontier Markets Net Total Return USD Index (+0.6%), and the MSCI World Net Total Return USD Index, which was up +0.4%. The performance of the AFC Asia Frontier Fund A-shares since inception on 31st March 2012 now stands at +77.6% versus the MSCI Frontier Markets Asia Net Total Return USD Index, which is up +48.1%, and the MSCI Frontier Markets Net Total Return USD Index (+40.9%) during the same time period. The fund’s annualized performance since inception is +11.6% p.a., while its YTD performance stands at +4.2%. The broad diversification of the fund’s portfolio has resulted in lower risk with an annualised volatility of 8.91%, a Sharpe ratio of 1.28 and a correlation of the fund versus the MSCI World Net Total Return USD Index of 0.34, all based on monthly observations since inception.

This was a tough month for the fund despite a very good performance of the fund’s Vietnam and Sri Lanka holdings which outperformed their respective markets by a large margin. The fund’s Vietnam holdings were up approximately +7.8% led by positive moves across most holdings as economic fundamentals continue to be positive. The recently announced 2Q17 GDP growth of 6.2% was better than the 5.2% growth reported in 1Q7 and what was more positive was manufacturing growth of 12.3% backed by foreign direct investment inflows and retail sales growing by 8.4%. The economic cycle continues to be on an upswing in Vietnam and it would not be surprising to see similar or higher GDP growth numbers in the second half of the year as has been the case historically.

The fund’s Sri Lanka holdings were up approximately +5.9% led mainly by a consumer conglomerate and a household products company which recently got listed on the local exchange. Low valuations as well as a pick up of construction activities on previously stalled infrastructure projects has led to more interest in the Sri Lankan stock market which has resulted in a good rally in our holdings so far this year.

The largest negative impact this month came from Pakistan which since inception has been the best contributor to returns for the fund. The KSE100 Index corrected by 8.0% this month which is its biggest monthly fall since September 2015 when it fell 7.0%. There are two major reasons for this correction: in anticipation of being upgraded to the MSCI Emerging Markets Index local investors had purchased the large cap names which were expected to be a part of the MSCI Emerging Markets Index in the hope of selling these securities to foreign emerging market funds. However, Pakistan received only a 0.1% weight in the MSCI Emerging Markets Index (0.15% was expected) which is very small for most global emerging market managers which led to lower than anticipated foreign inflows from 1st June 2017 onwards. This enticed the local investors to reduce their positions in these large cap names, more specifically the six names which made it to the MSCI Emerging Market Index. The weight of these six companies is ~29% in the KSE100 Index and they corrected between 14%-26% from the market’s peak on 24th May until 22nd June, just before the Ramadan break.

The other major reason for the weakness was the continuation of the “Panama Papers” drama surrounding the Prime Minister Nawaz Sharif. The Supreme Court in its verdict on 20th April 2017 did not disqualify the Prime Minister from holding office but instead appointed a Joint Investigation Team (JIT) to further investigate the matter. Tensions in the market rose as the Prime Minister was questioned by the JIT in mid-June and this has resulted in a lot of political noise regarding what impact this investigation will have on the Prime Minister. The investigation is expected to be complete by the second week of July 2017 and until this political noise dies down market sentiment could remain weak but we are not surprised by these political issues given that elections are expected to take place in May 2018.

Investors have also become concerned about Pakistan’s current account deficit and weaker foreign exchange reserves. Higher imports of machinery due to the China Pakistan Economic Corridor (CPEC) as well as higher volumes of oil related imports in addition to higher oil prices, have inflated the import bill, while weak exports and lower remittances have not provided any cushion to either the current account or foreign exchange reserves. Though these are valid concerns, the machinery imports are primarily related to CPEC projects which are being used to put up new power capacity which will help GDP growth rates in the future given the power deficit in the country. The increase of petroleum related imports is occurring not only due to higher prices but also higher volumes led by increased economic activity as is reflected in the higher passenger car and commercial vehicle sales over the past year. Furthermore, if oil prices stay where they are now, the impact of higher prices on imports should reduce in the second half of 2017 as oil prices have ranged between USD 45-55 over the past year.

Given that the current account deficit as a % of GDP is expected to be around 3% this year, the Pakistani Rupee is expected to weaken and this could cause short term cost pressures for most companies but to argue that the above issues diminish the case for investing or under weighting Pakistan is a bit exaggerated. The Pakistani Rupee depreciated by 8.0% in 2012 and 2013 respectively but the KSE100 Index gained 49% in both of these years.

The current political and macro issues are clouding out the more positive longer-term trends in Pakistan backed by the China Pakistan Economic Corridor (CPEC) projects (some of which have already been executed), an improving security situation and a large underpenetrated consumer market. Further, economic indicators such as private sector credit growth, automobile sales and cement sales continue to be positive while estimated GDP growth over the next five years is expected to average 5.5%. The last time such growth rates were achieved was between 2004-2007 when average GDP growth was 6.9%. So, to us it seems the economic cycle has only recently turned in Pakistan over the last 12-18 months and we would use any near term weakness to buy companies we like as further weakness in the market would only make valuations more attractive.

On 26th June Mongolia held its Presidential election where no candidate won more than the required 50% of the votes. Therefore, on 7th July Mongolia held its first ever Presidential run-off where Kh. Battulga of the Democratic Party faced off against the Mongolian People’s Party’s M. Enkhbold (the Mongolian People’s Party currently maintains a Supermajority in Parliament). During the runoff, Kh. Battulga won with 50.7% of the votes, while M. Enkhbold trailed with 41% and the balance of the votes being blank ballots. With Kh. Battulga’s win Mongolia now hosts a Nationalistic President and it remains to be seen how much of what he promised in his campaign will be implemented. Not an ideal candidate to reassure foreign investment, it is worth noting that the President’s powers are limited by the Mongolian People’s Party’s control of Parliament.

The best performing indexes in the AAFF universe in June were Vietnam (+5.2%), Bangladesh (+4.7%), and Sri Lanka (+1.1%). The poorest performing markets were Pakistan (-8.0%) and Iraq (-3.5%). The top-performing portfolio stocks this month were a Mongolian iron ore processing company (+33.3%), a Vietnamese construction company (+26.4%), a Sri Lankan conglomerate (+25.0%), and a Vietnamese real estate developer (+19.3%).

In June, we added to existing positions in Laos, Mongolia, Myanmar, Pakistan, and Vietnam and reduced our exposure in one Pakistani company and completely exited a Vietnamese battery producer. We newly added a Bangladeshi consumer finance company, a Vietnamese industrial park provider and a Vietnamese steel producer.

As of 30th June 2017, the portfolio was invested in 120 companies, 1 fund and held 5.0% in cash. The two biggest stock positions were a pharmaceutical company in Bangladesh (7.6%) and an investment company in Myanmar (2.8%). The countries with the largest asset allocation include Vietnam (27.6%), Pakistan (22.4%), and Bangladesh (16.4%). The sectors with the largest allocations of assets are consumer goods (30.6%) and healthcare (14.5%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 15.93x, the estimated weighted average P/B ratio was 2.87x, and the estimated portfolio dividend yield was 3.81%.

Factsheet AFC Asia Frontier Fund – June 2017

Factsheet AFC Asia Frontier Fund (non-US) – June 2017

AFC Asia Frontier Fund Presentation (English)

AFC Asia Frontier Fund Presentation (Chinese-Traditional)

AFC Asia Frontier Fund Presentation (Chinese-Simplified)

AFC Iraq Fund – Manager Comment June 2017

AFC Iraq Fund Class D shares returned −5.9% in June as the market continued the process of correction and profit-taking after the strong upside momentum that began in late summer of 2016.

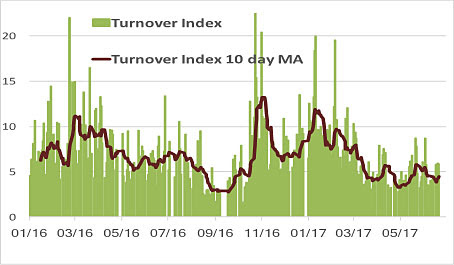

The Iraqi equity market, as measured by the RSISUSD index, ended an Eid shortened month, on 22nd June down −3.5% following the pattern set during the last few months, i.e. continued declines on low turnover (see chart below). However, the pace of the decline, decelerated somewhat from the last three months of −11.7%, −5.8%, and −6.7% respectively. However, unlike the last few months, the index spent most of the time in marginally positive territory with the declines taking place during the last week driven by heightened concerns of large scale foreign selling.

After a strong outperformance over the last two months with the fund’s average decline per month of −2.8% vs −6.2% for the index, the fund’s holdings were caught disproportionately more in the last week of selling. However, over half of the 2.4% underperformance is due to different sources of IQD to USD conversion used by the index magnified by the index’s last day of trading on the 22nd of June and the fund’s continued calculation of FX while demand for USD is seasonally high due to the Eid holidays and thus continued pressure on the IQD’s rate vs the USD.

Avg. daily turnover Index on the Iraq Stock Exchange (ISX)

(green) vs RSISUSD Index (red)

(Source: Iraq Stock Exchange (ISX), Rabee Securities, AFC)

(Note: Regular trading and excludes transactions by

insiders/Strategic holders whether local or foreign)

The effects of continued foreign selling, magnified by fears of more, were amplified during the last trading week before the Eid and summer holidays, in particular, one of the “bluest chip” banks bore the brunt of selling declining −9.5% for the month on the back of declines of −5.3%, and −17.8% for the last two months respectively. Towards the end of June, the bank released its 2016 annual report with the board proposing a dividend, which would be equal to a 7.5% yield based on the closing price for the month. With local liquidity in the early phases of recovery and still scarce, anticipation of continued foreign selling exerted an amplified negative effect on the overall market as concerns of a replay of the early part of 2016 came to the forefront.

As is often the case when markets are dominated by fear, real or otherwise, market participants tend to focus exclusively on them and their implications and ignore all other developments. Over the last three months, the local participants at the Iraq Stock Exchange (ISX)’s obsessive focus has been on significantly increased foreign selling as a percentage of all selling while at the same time they tended to ignore the developing build-up of foreign buying which has been increasing in parallel. The chart below shows daily foreign buying and selling as a percentage of respective totals going back to 2016 overlaid by 10 day moving averages of these percentages.

Foreign buying (green) as a percentage of all buying

and foreign selling (red) as a percentage of all

selling on the Iraq Stock Exchange (ISX)

(Source: Iraq Stock Exchange (ISX), AFC)

(Note: Regular trading and excludes transactions by

insiders/strategic holders whether local or foreign,

MA’s are 10-day moving averages)

At first glance, the last three-months of foreign selling seems similar to those of the first terrible six months of 2016 and as such confirms the market’s fears. Yet, a close examination reveals that the two periods differ in three crucial ways that are being overlooked:

- Current selling is not as persistent and widespread as that of early 2016, which indicated redemptions but not the wholesale portfolio selling of 2016 as is implied by the different bulges of light red lines in the chart above;

- Moreover, the net effect, i.e. current net foreign selling, is very different from that of early 2016 as the then selling overwhelmed buying, while the recent trend in net selling has been decreasing from negative to almost neutral as buying has been picking up as can be seen from the chart below;

- Finally, current turnover is meaningfully less than that of early 2016 as can be seen from the second chart below and as such the low liquidity tends to magnify the negative effects of any selling.

Net Foreign Turnover index on the ISX (green) vs 10-day average (red)

Turnover Index on the ISX (green) vs 10 day moving average (red)

(Source: Iraq Stock Exchange (ISX), AFC)

(Note: Regular trading and excludes transactions by

insiders/strategic holders whether local or foreign)

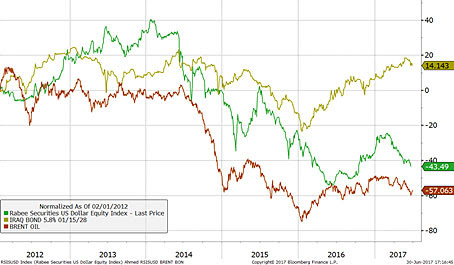

The recent foreign behaviour, either real or feared, on the ISX is in sharp contrast to that of Iraq’s Euro Dollar Bond (USD 2.7 bln, issued 2006, due 2028 with a 5.8% coupon) which continues to trade at heights last seen in early 2014 (see chart below) indicating a positive view of Iraq. As the bond trades internationally and institutionally, it is not subject to the same liquidity constraints or fears of the local equity market and therefore it is a much better indicator of foreign interest in Iraq, just as importantly showing a high foreign confidence in Iraq’s sovereign rating. This underpins the assumptions, made here, that Iraq’s rehabilitation in the eyes of foreign institutional investors continues and logically should lead to accelerated FDI’s and eventually equity inflows into the Iraqi equity market. Moreover, given that the reasons for the divergence for the last three months are due to local liquidity concerns amplified by foreign selling, the end which should lead to the reassertion of the historic correlation in much the same way that it did last year. The opportunity that this divergence provides is arguably greater this year than that of 2016, as the end of conflict is within sight and Iraq is no longer at the mercy of low oil prices and escalating cost of war as it was for much of the last 2.5 years. The change in circumstances brought by the reversal of these circumstances, i.e. de-escalating and eventually declining costs of war, higher oil prices so far in 2017, foreign aid and loans should be highly positive for the economic recovery post-conflict.

Rabee Securities’ RSISUSD Index (green),

Iraq’s USD 2.7 bln Bond (gold) and Brent Crude (red)

(Source: Bloomberg as of 30/06/17)

The often-cited statement in these newsletters that “a change of direction is at hand with the opportunity to acquire attractive assets that have yet to discount a sustainable economic recovery” is still very much in play but as equally often stated “the recovery will likely be in fits and starts with plenty of zig-zags along the way as liquidity is still scarce with a time lag before it can filter down into the economy.”

The liberation of Mosul should be followed by the reconstruction of the city and the liberated areas which would be the theme for the Iraq investment story over the next few years. While the government is targeting about a USD 100 bln for the reconstruction of the liberated third of the country and seeking international aid/loans for this endeavour, the reconstruction effort is led by the local population acting on their own accord. Reports from Mosul and Ramadi show local rebuilding starting with clearing the wreckage of war, re-installing basic services, repairing & rebuilding of homes, businesses reopening and all efforts being aimed for a return to normality, but crucially it is coupled with an accelerated and unprecedented inflow of foreign aid led by the UN as this CBS News article shows. The sense of a determined return to normality can be felt from the images of cafés and restaurants teeming with life in Mosul especially in the last few days of Ramadan and during Eid while the last sounds of war were deafening in the remaining ISIS pockets in Mosul’s old city.

As of 30th June 2017, the AFC Iraq Fund was invested in 14 names and held 1.3% in cash. The fund invests in both local and foreign listed companies that have the majority of their business activities in Iraq. The countries with the largest asset allocation were Iraq (97.8%), Norway (1.8%), and the UK (0.4%). The sectors with the largest allocation of assets were financials (53.4%) and consumer staples (25.1%). The estimated trailing median portfolio P/E ratio was 10.24x, the estimated trailing weighted average P/B ratio was 0.92x, and the estimated portfolio dividend yield was 3.30%.

Factsheet AFC Iraq Fund – June 2017

Factsheet AFC Iraq Fund (non-US) – June 2017

AFC Iraq Fund Presentation

AFC Vietnam Fund – Manager Comment June 2017

The AFC Vietnam Fund returned +4.5% in June with an NAV of USD 1,867.93, a new all-time high, bringing the net return since inception to +86.8%. This represents an annualised return of +19.4% p.a. The June performance of the Ho Chi Minh City VN Index in USD was +5.2% while the Hanoi VH Index gained +5.5% (in USD terms). Since inception, the AFC Vietnam Fund has outperformed the VN and VH Indices by +45.0% and +51.9% respectively (in USD terms). The broad diversification of the fund’s portfolio resulted in a low annualized volatility of 8.87%, a high Sharpe ratio of 2.16, and a low correlation of the fund versus the MSCI World Index USD of 0.30, all based on monthly observations since inception.

June was another strong month and stocks across the board continued to rise, bringing the main index in HCMC to a new multi-year high. The financial sector in particular was strong, while small- and mid-cap stocks caught up later during this rally.

Market developments

The market continued its strong upward move over the month of June. However, looking longer term, in order to better understand the future potential of Vietnamese stocks we need to dig deeper and look into recent developments of various sectors and market trends.

Over the past few weeks we refrained from investing in some stocks which performed quite nicely, even though they are loved by analysts and foreign investors. In our view, they are simply overrated and expensive, and hence have vastly underperformed the market over the past several years. On the other hand, we identified a large number of extremely undervalued small cap stocks a few years ago which were performing extremely well between 2012 and 2014, but then “only” went up in line with the general market. Of late it has been interesting to note that quite a few of these stocks have traded limit up on certain days over the past few weeks, which is a rather rare event since this hasn’t happened for a very long time. If we look at the market breadth of the past three months, we finally see a strong recovery in the net number of advancing stocks. Looking further back, we see that this is hopefully only the beginning of a longer-term trend of a broad market rally.

Advance/Decline Ratios

(Source: Bloomberg)

With strong gains seen in recent months some people are concerned that the markets got ahead of themselves and could offer only limited upside potential in the near future. In reality, we were expecting Hanoi to finally break out of its long-term consolidation phase, having written about it on several occasions. Despite the recent index gains, we are now only 10% above the highs of 2014, while still trading more than 70% below the market peak of 2007! It is true that the headline valuation of the market has almost caught up with other markets in the region, but that has mainly to do with a rally in a few expensive and heavily weighted index stocks. With our portfolio still valued around 10 times earnings and with quite a few newly added and inexpensive stocks, we see plenty of upside for both the near and long-term.

Vietnam is now seen as one of the growth engines of Southeast Asia and we certainly agree. Over the next 10-20 years, the country will simply catch up with other economies in the region as Vietnam opened up much later. Some of the drivers of this will certainly be Vietnam’s much better educated, motivated and younger workforce. Another example is the growing tourism sector which was not considered as important in the past.

The tourism boom is just getting started

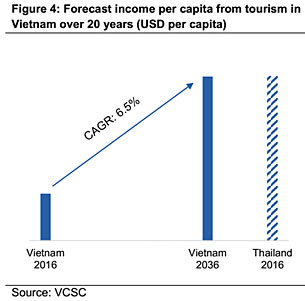

Vietnam is seeing a sustained boom in domestic tourism driven by rising discretionary income. With GDP per capita of around USD 2,100, Vietnamese people are willing to pay for travel and leisure. Domestic tourist arrivals grew by 8.7%, reaching 62 mln in 2016, and are expected to keep growing strongly this year. We expect that Vietnam can reach the current level of Thailand by 2036.

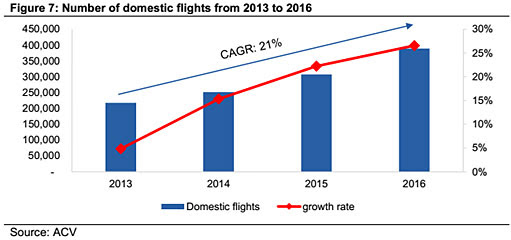

The entry of low cost airlines is providing massive stimulus to domestic tourism. Vietjet is a major enabler of the domestic tourism boom as its aggressive pricing is attracting a new class of “first time flyers” who are trading up from traditional surface transportation mediums. Geographically, Vietnam is a long and narrow country where it takes 1.5 days to move from Ho Chi Minh City to Hanoi by bus compared to 2 hours by air. Before the arrival of Vietjet, the airfare to fly from Ho Chi Minh City to Hanoi was nearly USD 270, but since then prices have dropped to as low as USD 110 per round trip.

Vietnam is also a big beneficiary of the surge in outbound Chinese tourism. Vietnamese beach resorts including Da Nang and Nha Trang have become very popular destinations for Chinese tourists. China accounted for nearly one third of all international tourist arrivals into Vietnam in 2016, growing by more than 50% Y-o-Y.

However, a huge number of Chinese tourists are also traveling by bus to Vietnam. For example, there are thousands of Chinese tourists crossing the border daily at Mong Cai in Quang Ninh province. These tourists are mainly attracted by Vietnam’s 3,000km long coastline and its affordable pricing.

Thousands of tourists queue up daily at the Dong Hung –

Mong Cai border gate

(Source: www.anninhthudo.vn)

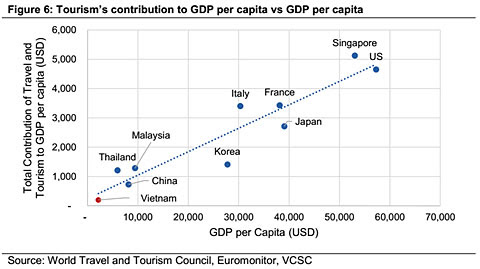

Due to this impressive growth in tourism, quite a few sectors are benefiting nicely, such as the hospitality and consumer sectors. The overall contribution of these sectors to GDP is still relatively low, especially in comparison to other countries in the region, but they are expected to grow rapidly over the coming years.

Economy

Source: AFC research, SSI, GSO, SBV, VCB

The Vietnamese economy saw a strong recovery in the second quarter of this year, with GDP growth of 6.17% compared to 5.15% in the first quarter. GDP expanded more rapidly in the first half of 2017, with 5.73% compared to 5.52% in the same period last year.

GDP Growth

(Source: VCSC, GSO, AFC Research)

At the end of June 2017, the fund’s largest positions were: Agriculture Bank Insurance JSC (4.2%) – an insurance company, Sam Cuong Material Electrical and Telecom Corp (2.4%) – a manufacturer of electrical and telecom equipment, Pharmedic Pharmaceutical Medical JSC (2.2%) – a pharmaceutical company, Dong Phu Rubber JSC (2.0%) – a producer of rubber and rubber products, and Cantho Pesticides JSC – a manufacturer of agricultural chemicals (1.8%).

As of 30th June 2017, the portfolio was invested in 77 names and held 2.5% in cash. The sectors with the largest allocation of assets were consumer goods (34.6%) and industrials (24.1%). The fund’s estimated weighted average trailing P/E ratio was 10.48x, the estimated weighted average P/B ratio was 1.68x and the estimated portfolio dividend yield was 6.56%.

Factsheet AFC Vietnam Fund – June 2017

AFC Vietnam Fund Presentation

AFC Travel Report – Myanmar

Scott Osheroff, Regional Research Analyst at Asia Frontier Capital, who currently resides in Myanmar, recounts one of his recent trips in the frontier country. The photos in this article are all by AFC.

On a blisteringly hot April afternoon I left my apartment in search of lunch. Eerily quiet as I walked down the road, with not a car in sight, I was suddenly approached by a seemingly innocent girl, save for the fact that she was armed. Knowing what would ensue I became uneasy, not wanting any trouble of course. With phones and my wallet in tow, after a short while of gentle negotiation for her to save her ammo for another victim she unfortunately lifted her weapon and said a soft “sorry” as she pulled the trigger, pumping copious amounts of water onto me. Thoroughly drenched, she yelled “Happy Thingyan!” and with a big smile ran off to go reload for the next pedestrian or car with windows ajar to pass.

Thingyan is the Buddhist New Year which in Myanmar is synonymous with loud music and trucks packed with people focused on getting as hydrated as possible all amid borderline chaos. During this period, Myanmar turns into a nation-wide waterpark and Yangon in particular into a madhouse, the following photo of which puts this into perspective. It is great fun!

Platforms set-up throughout the city where cars drive up and get hosed with water.

Early in the morning on the fifth day of Thingyan I had plans to depart Yangon for Shan State. Leaving early in the morning, I had a 9-hour drive ahead. The first leg of this journey was the drive to the edge of Yangon where we reached the Yangon-Mandalay toll road. Infrastructure lagging vehicle growth, this ~8-kilometer drive should have taken 20 minutes, but instead took an hour.

On the entrance to the highway we approached the first toll gate where we had to pay for the stretch Yangon-Naypyidaw, Myanmar’s capital. This section is 360 kilometres yet costs a mere 5,000 Kyat (USD $3.66). How the highway is so well maintained, while the fare is so low for this Build-Operate-Transfer (BOT) concession I can only imagine, but I wasn’t complaining as this was one of the best highways I’ve travelled on during my five years living in Asian frontier markets.

Some 150 kilometres past Naypyidaw we exited the highway onto a single lane country road where the topography experienced dramatic change from previous scrubland to rice paddy and then increasingly forest as we entered the Shan mountain range. Passing through several quaint villages with many vehicles being horse powered, we eventually passed a bridge and on the other side were greeted by a sign saying “Welcome to Shan State” in Burmese. For the next 1.5 hours we faced endless switchbacks which, while treacherous at certain points with the occasional truck careening around the corner into our lane, were also stunningly beautiful as the topography changed into something you may see in the Colorado Rockies or even northern Mongolia. For a good length of time we paralleled a valley-floor river with elephants being washed by their mahouts before beginning our 1,000 metre ascent.

As we continued our climb yet higher it became readily apparent why for centuries Shan State has remained either wholly or semi-autonomous—if the British hadn’t built the road we were driving on there would be no “easy” access to the area. The Shan plateau is largely impenetrable and equally gorgeous.

Terraced rice paddy near Aung Pan, Southern Shan State.

With dusk upon us we reached the top of the switchbacks and raced through Kalaw, a town renowned for its trekking, followed by another toll gate as we continued onward to Taunggyi, the capital city of Shan State. Something which humored me about this toll gate (and many others for that matter) is that the fee for our car was 870 Myanmar Kyat (MMK). We gave a MMK 1,000 note, but the smallest note in Myanmar is MMK 50 and this being Myanmar there was only one “obvious” way for the toll operator to give us our change. She reached into a bag and gave us a handful of small candies!

Finally, around 7pm, we arrived in Taunggyi and after a grueling day’s drive settled into a simple meal of Shan tomato salad and Myanmar’s famous tea leaf salad, also indigenous to Shan State, before settling in for the night.

The next morning, we awoke and headed down the street to a local, open air tea shop to indulge in a bowl of dry Shan noodles with a side of piping hot soup. Washed down with a glass of Myanmar tea, I was ready for the 30-minute drive to Nyaung Shwe, a town well-known for its location just north of Inle Lake and its relaxed atmosphere.

Nyaung Shwe used to be a largely agricultural town where sugar was a staple crop, but the mills have long since closed and over the past several years tourism has become the new growth driver with most every house having transformed into either a hotel or restaurant. A quaint town, the number of hotel keys is certainly a few years ahead of the tourist inflow needed to provide profitable occupancy ratios. Nonetheless, I spent a short while exploring the downtown area and then proceeded to rent a boat on one of the city’s two canals, which lead into Inle Lake, for a morning tour.

We rented a long boat with a deafening engine and long propeller as the depth of the lake during the dry season is quite shallow (in certain areas not more than 40 centimetres). As we set sail, speeding down the canal passing wetlands which will one day inevitably be transformed into resorts, we entered the lake. Not much further on and our guide slowed down as we came upon the famous Inle fishermen who row with their feet. This was followed by a several hectare floating tomato garden and yet onward a floating pagoda and a textile factory where they turn lotus root into thread and from there weave everything from scarves to handbags and traditional Myanmar clothing. The lotus scarves were remarkably intricate and the starting price was USD 100!

Inle fisherman posing for a photo.

A nursery school in the floating village.

A woman opening lotus roots to then create thread for weaving.

After lunch on the lake at a floating restaurant we “putt putted” back towards Nyaung Shwe where en-route we were caught in a rainstorm. It was beautiful seeing a wall of water sweep across the northern part of the lake heading south where when it suddenly hit us we had umbrellas open.

Heading into a rainstorm on Inle lake.

That evening I rented a bike and rode about 15 minutes out of Nyaung Shwe to Myanmar’s most famous winery, Red Mountain. After touring the property and strolling through the vineyard I settled on the patio for dinner and a glass of wine overlooking Nyaung Shwe and Inle Lake as the sun began to set.

This visit to Shan State showed me the immense potential Myanmar has to attract tourists and FDI for that matter. Though, it will undoubtedly take time for them to come, they will surely come. As the pace of inflows increase, it will also create new listed opportunities for AFC to invest into. We remain long term optimists on the development of Myanmar and upbeat about the country’s prospects.

Sorry, comments are closed for this post.