“The only way to stay consistently ahead of the game is

to adopt a long-term view and, if appropriate,

with a strong contrarian spin.”

– Marc Mobius.

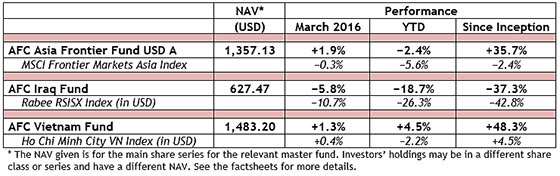

AFC Funds Performance Summary

This past month we have again received several accolades for the outstanding work of our team:

Lipper’s Citywire has again listed AFC Asia Frontier Fund as its top performing fund over 1 and 3 years in the category “Equity – Frontier Markets” in which a total of 46 funds are listed.

s mentioned in last month’s newsletter, BarclayHedge ranked the AFC Vietnam Fund in the top 10 funds for monthly performance in January 2016 in two sectors: Emerging Markets–Asia and also Emerging Markets Equity–Asia. We are glad to let you know that we extended this performance into February and have been given the same awards again. This is a testament to our consistent dedication to careful risk management, excellent portfolio construction, and expert stock selection.

AFC was awarded “Investment Funds Advisory Firm Of The Year” as well as “Most Outstanding in Fund Management–Asia” as a result of hard work and dedication to our tested fund management process that consistently delivers significant outperformance with markedly low volatility.

AFC Funds registered in Japan, Singapore, and United Kingdom

In order to better address the needs of investors worldwide, we have recently registered our funds for distribution to professional investors in Japan, Singapore, and the United Kingdom in addition to the jurisdictions of Switzerland and Hong Kong where we already had distribution status of our funds for offer to professional investors.

Ahmed Tabaqchali presenting at “The Asian Banker Summit 2016”

Ahmed Tabaqchali, the CIO of the AFC Iraq Fund, will be making a presentation to delegates atThe Asian Banker Summit 2016, to be held at the JW Marriott in Hanoi from 10th – 12th May 2016. He will be speaking there on Financial Market Infrastructure.

AFC in the Press

|

Bloomberg: Stock Trading Comes to Myanmar With First Company Listing |

Upcoming AFC Travel

If you have an interest in meeting with our team during their travels, please contact Peter de Vries at pdv@asiafrontiercapital.com.

| Ho Chi Minh City | 5th – 15th April | Scott Osheroff |

| Phnom Penh | 16th – 30th April | Scott Osheroff |

| Zurich | 18th – 19th April | Andreas Vogelsanger |

| Zurich & Luzern | 20th April | Andreas Vogelsanger |

| Geneva | 21st April | Andreas Vogelsanger |

| London | 22nd April | Andreas Vogelsanger |

| Shanghai | 22nd – 23rd April | Thomas Hugger |

| Zurich | 25th April | Andreas Vogelsanger |

| Hong Kong | 8th – 20th May | Andreas Vogelsanger |

| Hanoi | 10th – 12th May | Ahmed Tabaqchali |

| Hong Kong | 13th – 14th May | Ahmed Tabaqchali |

| Toronto | 27th June | Thomas Hugger |

| New York | 28th June – 2nd July | Thomas Hugger |

AFC Asia Frontier Fund – Manager Comment March 2016

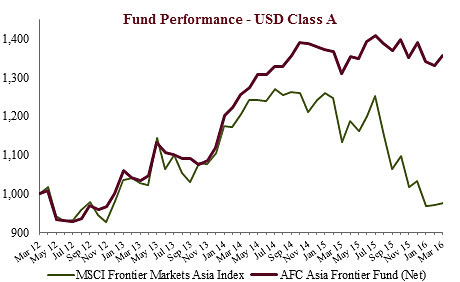

AFC Asia Frontier Fund (AAFF) ) USD A-shares gained +1.9% in March 2016. This month the fund outperformed the MSCI Frontier Markets Asia Index (+0.3%) and the MSCI Frontier Markets Index (+1.1%) but underperformed the MSCI World Index (+6.5%). The performance of the AFC Asia Frontier Fund A-shares since inception exactly 4 years ago on 31st March 2012 stands now at +35.7% versus the MSCI Frontier Asia Index which is down −2.4% and the MSCI Frontier Index (+1.5%) during the same time period.

The fund continues to outperform its benchmark in a volatile year and positive performance this month was primarily thanks to the fund’s bigger holdings in Pakistan and Vietnam. The fund’s Pakistani cement stocks continued to do well in terms of price performance as domestic cement sales in the country continue to grow in double digits on the back of a pickup in construction activities. The other major positive contributors in Pakistan were a pharmaceutical company and a consumer foods company which the fund entered into last month. A major corporate development in Pakistan was the news that Dutch dairy company Friesland Campina is looking to acquire a 51% controlling stake in Engro Foods, one of Pakistan’s leading dairy companies. The 51% stake could be valued at >USD 500 million and no announcement on pricing has been made. This deal, if it goes through, will be a positive for the consumer story in Pakistan as well as for valuations of consumer staple companies.

Positive performance in Vietnam continued to be aided by the fund’s construction/infrastructure related companies which continued to do well on a positive outlook. Other larger holdings such as a pharmaceutical company, consumer foods company, and a lighting products company also did well. Following our visit last month to the country, we continue to be positive on cyclical companies in Vietnam.

As discussed in last month’s manager comment, Sri Lanka faces macro headwinds due to its balance of payments issues as well as its fiscal deficit. The country is looking to receive funding of about USD1.5 billion from the IMF to plug the gap in its balance of payments, but with ~USD4.6 billion in USD debt repayments over the next twelve months, there could still be some pressure on its currency given foreign exchange reserves of ~USD6.3 billion. The government also recently rolled back lower corporate tax rates which were passed in the November 2015 budget and also increased Value Added Tax rates. Though this is a positive, the fund’s exposure to Sri Lanka was reduced further given the macro outlook.

This month, the best performing indexes in the AAFF universe in March were Pakistan (+5.6%) and Vietnam (+0.3%). The poorest performing markets were Mongolia (−7.4%) and Iraq (−6.8%). The top-performing portfolio stocks were an oil and gas company from Myanmar (+74.5%), followed by a Vietnamese food producer (+40.9%), a Vietnamese construction company (+22.9%), and a Pakistani pharmaceutical company (+19.9%).

In March we added to existing positions in Bangladesh, Mongolia, Pakistan, and Vietnam. We added a Pakistani healthcare provider and a Sri Lanka consumer goods distributer to the portfolio. We completely exited a Vietnamese agricultural products company and a Vietnamese jewelry chain. We reduced our holdings in seven Sri Lankan companies, a Vietnamese stationery company, and a Mongolian consumer product company.

As of 31st March 2016, the portfolio was invested in 101 companies, 1 fund, and held 8.3% in cash. The two biggest stock positions were a pharmaceutical company in Bangladesh (5.8%) and a Pakistani pharmaceutical company (4.9%). The countries with the largest asset allocation include Vietnam (32.3%), Pakistan (20.4%) and Bangladesh (14.6%). The sectors with the largest allocation of assets are consumer goods (37.8%) and healthcare (16.4%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 14.24x, the estimated weighted average P/B ratio was 1.49x, and the estimated portfolio dividend yield was 3.27%.

For more information about Asia Frontier Capital’s Asia Frontier Fund please click the following links:

Factsheet AFC Asia Frontier Fund – March 2016

Factsheet AFC Asia Frontier Fund (non-US) – March 2016

AFC Asia Frontier Fund Presentation (English)

AFC Asia Frontier Fund Presentation (Chinese-Traditional)

AFC Asia Frontier Fund Presentation (Chinese-Simplified)

AFC Iraq Fund Manager Comment March 2016

AFC Iraq Fund Class D shares returned −5.8% in March 2016 with an NAV of USD 627.47, this an outperformance of +4.9% compared with the Rabee RSISX USD Index (RSISUSD) which returned −10.7% in USD terms. The fund has outperformed the RSISUSD by +5.6% since inception.

The liquidity crunch, a main cause for the steep market declines over the last few months, came to a climax in March with a combination of un-related events that together took a significant toll. The first event was the delayed effect of lower oil prices earlier in the year on government revenues and subsequently on spending, with the government underspending on wages & pensions, goods & services, and investments. These intensified liquidity shortages in the economy pressured the Iraqi Dinar (IQD), which declined about −2.7% in March, in a replay of early 2015. In IQD terms, the fund returned about −2.8% vs −9.2% for the Index.

The second event was the sale of HSBC’s 8.8% holding in Dar Es Salaam Bank, worth about USD 8m by end of 2015. In 2013 HSBC decided to sell its then 70.1% holding, acquired in 2005, as part of a regional re-organization. Its plan to give away the shares to existing holders was blocked by the regulator, and the bank then diluted its holding to 58.2% by not participating in a capital increase. In October 2015, it sold 50% to a group of Iraqi investors and sold the rest in 2016.

The third event is the reported liquidation process of a sizeable foreign Iraq fund (about USD 12m by end of January). The last two events probably accounted for USD 10-15m during the quarter vs the monthly average of USD 16m over the last 6 months.

On the flip side, locals continued to be active, with the absorption of the sales putting pressure on other stocks as the available liquidly was rotated around, as can be seen in performance of major banks such as Iraq Middle East Bank (−21.4%), Bank of Baghdad (−17.3%), Mansour Bank (−8.9%), and Gulf Commercial Bank (−8.9%), while Dar Es Salaam Bank itself was down −17.6% during the month and −48% YTD. The banking group continues to be attractive as discussed in last month’s newsletter with the main take away being that current low valuations are based on depressed earnings that are a function of a country in conflict and as such don’t reflect the earnings potential of the group once the country is on the path to recovery.

Seen in the context of the above, the market’s decline of −26% YTD is caused mostly by technical as opposed to fundamental factors, the removal of which should result in it reclaiming most of the losses. Moreover, it underscores the resilience and potential of the market which even with diminished local liquidity still absorbed these significant sales, granted with meaningful losses but far from what would be expected from such a small & nascent market. Current levels continue to be exceptionally attractive to acquire quality assets that are discounting most conceivable negatives and none of the potential positives with the market, as measured by the RSISUSD Index, down −57.5% from the peak in December 2013 highs.

RSISUSD Index vs total market cap.

(Note: the spoke in market cap was due to a significant new listing in June 2015)

(Source Rabee Securities & IS.)

March featured two important developments for the country. The first was a rare visit by U.N. Secretary General Ban Ki-Moon, World Bank President Jim Young Kim, and President of the Islamic Development Bank (IDB) Ahmad Mohamed Ali. The heads of the three bodies re-iterated their commitment to Iraq and pushed for continued national reconciliation and economic reforms. Jim Young Kim added that Iraq would “feature prominently” in the bank’s plans to invest $20 billion in the region by 2021, without providing details. And the president of the IDB added that the bank would contribute to the reconstruction of liberated areas. The second piece of news is that the IMF could approve, as early as June, a standby arrangement (SBA) with Iraq providing $15 billion in international assistance over the next three years, with one third from the IMF and the rest from international groups and donor countries. These developments confirm part of the thesis of this fund in that all these bodies are heavily invested in Iraq’s future and of the potential for the massive capital investment cycle that the region will see over the next few years as part of the long term solution to combat the rise of extremism.

Regional developments have been very positive with (1) the significant military defeats for ISIS in Syria and Iraq plus increasing reports of internal dissent within ISIS brought upon by the unsustainable dynamics of the caliphate as highlighted in December’s newsletter; while (2) the imperfect “cessation of hostilities” in Syria has led to an equally imperfect peace process which is taking place while the main sponsors, the US & Russia, seem to be in perfect alignment on the process plus reports of possible military coordination of the two against ISIS in Syria. These add weight to the predictions made in December that “… the surprise of 2016 could very well be the speed of the crumbling of the ISIS caliphate…”

Looking at the portfolio, as of 31st March 2016, the AFC Iraq Fund was invested in 14 companies and held 0.9% in cash. As the fund invests in both local and foreign listed companies that have the majority of their business activities in Iraq, the countries with the largest asset allocation were Iraq (95.1%), Norway (3.9%), and the UK (1.0%). The sectors with the largest allocation of assets were financials (47.2%) and consumer staples (28.7%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 19.64x, the estimated weighted average P/B ratio was 1.18x, and the estimated portfolio dividend yield was 4.21%.

For more information about Asia Frontier Capital’s Iraq Fund, please click the following links:

Factsheet AFC Iraq Fund – March 2016

Factsheet AFC Iraq Fund (non-US) – March 2016

AFC Iraq Fund Presentation

AFC Vietnam Fund – Manager Comment March 2016

To read this month’s fund update in German please click here.

The AFC Vietnam Fund gained +1.3% in March to a NAV USD 1,483.20, bringing the net return since inception to +48.3% or +18.4% annualized. By comparison, the March performances of the Ho Chi Minh City VN Index and the Hanoi VH Index were both +0.4% (in USD terms). Since inception the AFC Vietnam Fund has outperformed the VN and VH Indices by +43.9% and +38.7% respectively (in USD terms).

The recovery from the initial weakness at the beginning of the year continued in the first half of March, but then came to a halt due to counter-movements in the USD and commodity prices. After massive price increases in various previously sold off markets such as e.g. oil (+50%) and Brazil (+40%), we saw some profit taking. The focus is once again on the Fed, which could further raise interest rates signalling the end of the deflationary environment. The same underlying assumptions serve both camps; on the one hand as a buy argument for risk assets (commodities, emerging markets and their currencies), and on the other hand a sell reason for pessimistic investors (interest rate increase and a renewed selloff of risk assets). These mood swings of short-term “investors” will probably continue to pursue us in the coming weeks and months until a somewhat clearer trend has been established.

US-Inflation rate

(Source: dshort.co)

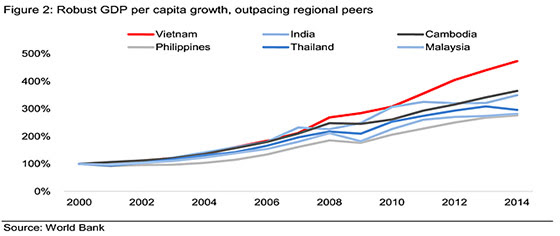

Even clearer to recognize is the turning point of inflation in Vietnam. The year on year inflation rate increased to 1.25%, after some fears of deflation arose, which is rather absurd for an emerging country in the midst of an economic recovery. The inflation rate is expected to rise to more than 3% by year end which is still considered very low for Vietnam, mainly due to the disappearing base effect of cheap oil in the second half of 2016. The recently published Q1 GDP growth rate of 5.5% was a little disappointing – about 0.5% below the previous year’s Q1 number. The main reasons were the negative development of agriculture caused by the “El Nino effect” and the slightly lower growth of exports as a result of weakness in the economies of the importing countries. Nevertheless, with a very robust domestic demand, the growth rate should be well above 6% for the full year.

Even more impressive compared to other Asian countries is Vietnam’s growth rate adjusted by the population growth factor. Although the headline growth rate in countries like Cambodia or Philippines is very similar, their birth rate is significantly higher than in Vietnam.

From a market technical viewpoint, we will hopefully test the index highs of the previous year in Q2, as soon as the current correction is over. The overall market is trading only near the average of the past two years, although our March NAV closed on a new all-time high for the fund.

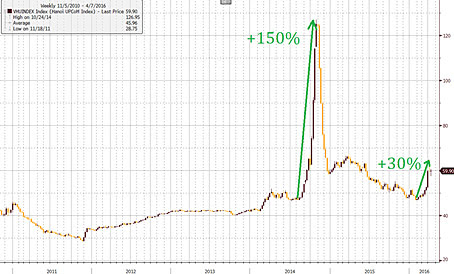

Ho Chi Minh City VN Index – 2.5 years

(Source: Viet Capital Securities)

We have always emphasized in our arguments that we are expecting to see a long-term bull market in Vietnam (which has paused now for already two years!), which will initially be driven by a revaluation to the level of regional markets and then a potential exaggeration on the upside as it happens worldwide on a more or less regular basis. It is undisputed that the mentality of the Vietnamese people would fit this profile very well – and selectively can already be seen in a market driven by rumours. On the speculative UPCOM market, the third market in Vietnam for newly listed shares and companies with a lower reporting standard, we saw a 30% increase in the index in March alone. This raise even compares relatively modestly to the 150% increase in 2014 and the 50% correction shortly after in only 6 weeks.

UPCOM 2015-2016

(Source: Viet Capital Securities)

UPCOM 2010-2016

(Source: Viet Capital Securities)

Occasionally we also see this speculative wave moving into Hanoi small-caps, similar to autumn 2014, when we decently outperformed the market, although we have only invested into a single stock long term with a weighting of about 1% on the UPCOM market. Nevertheless, we think that in the future such speculative waves will also be seen on the two main exchanges at a probably more modest pace and the very low price fluctuations of the two main indices by international standards will come to an end – in a positive sense! Japan, Taiwan, Thailand, China, the US Nasdaq, Neuer Deutscher Markt, Eastern Europe, etc … all these markets had their excesses during their economic upswing – so why not Vietnam?

At the end of February the fund’s largest positions were: Sam Cuong Material Electrical and Telecom Corp (3.2%) – a manufacturer of electrical and telecom equipment, Nui Nho Stone JSC (2.0%) – a stone mining company, Thuan An Wood Processing JSC (1.9%) – a wooden furniture manufacturing company, Petrovietnam Fertilizer and Chemical JSC (1.8%) – a fertilizer manufacturer, and Doan Xa Port JSC (1.8%) – a logistics company.

The portfolio was invested in 83 names and held 4.3% in cash. The sectors with the largest allocation of assets were consumer goods (36.3%) and industrials (23.7%). The fund’s estimated weighted average trailing P/E ratio was 7.77x, the estimated weighted average P/B ratio was 1.12x and the estimated portfolio dividend yield was 6.25%.

For more information about Asia Frontier Capital’s Vietnam Fund please click the following links:

Factsheet AFC Vietnam Fund – March 2016

AFC Vietnam Fund Presentation

Laos Travel Report – March 2016

In line with our process of being on the ground in the countries we invest in, Scott Osheroff (Regional Research Analyst), travelled to Laos to meet with company executives and government officials.

Vientiane, Laos. Sitting on the veranda of the Khamvongsa Hotel sipping an espresso in the early morning dawn, I am shivering. Wearing a pair of pants and a heavy jacket, the morning chill is yet to give way to another scorching hot Lao day. From this seat I am able to indulge in the nostalgia that once was French colonial Laos as the hotel is a reconstruction of buildings from the era. However, as I look out onto the street there is nothing to be nostalgic about as a seemingly endless stream of Toyota Hilux pick-up trucks pour by and smartphones rule the hands of everyone walking past. It is safe to say Laos has firmly arrived in the 21st Century.

Traditional Laos meets modernity in the city center

(Source all photos: AFC)

Swensen’s Ice Cream and The Pizza Company in Vientiane

A crossroads, Laos in recent years has realized billions of dollars of FDI from the Chinese, Thais, and Vietnamese in a bid for influence. Laos is both strategically located between its respective neighbors, as well as boasting immense natural resources including gold, potash, copper, coal, and hydroelectric potential. This battle for influence is seemingly being won by the Vietnamese at present (with over USD 6 billion invested to date) as you could mistake various parts of Vientiane as a Vietnamese village with the country’s flag flying high over government and private buildings alike.

Luckily, as I was sipping my Dao Coffee (the largest and most well-known coffee producer in Laos) on the veranda of my hotel I knew I was firmly in Laos. Dao Coffee I must say trumps any Vietnamese coffee I have previously consumed and led me to leave the country with 2kg of the black gold (I should have bought more)! Largely unknown outside of Laos and Thailand, Dao operates coffee plantations, coffee processing, dried fruit production, and duty free shops. The quality of Dao’s products is unparalleled with their regional competition, something I didn’t expect when I touched down. Luckily their growth plans are to share this secret with the rest of the world.

I met a Managing Director of the Dao Group of Companies at their headquarters, and we discussed their planned IPO on the Laos Stock Exchange (LSX) in 2017. The capital raise will help the company expand areas under coffee cultivation, acquire new European processing equipment, and expand sales and marketing both in Laos and internationally. The majority of coffee consumed in Laos is still either Nescafé instant coffee or Vietnamese coffee, and so the low hanging fruit will be to increase local market share, which at present is only ~25%. I’m confident they will be able to grow market share with relative ease.

Dao Group Duty Free Shop at Wattay International Airport in Vientiane.

Another memorable visit was to the largest of the five listed companies on the Lao Stock Exchange (LSX), EDL Generation Company (EDL-Gen). A subsidiary of the national electric company EDL, EDL-Gen owns hydroelectric dams built by EDL, in addition to joint ventures with third party independent power producers (IPP’s). Having a mandate to supply EDL with 90% of the electricity distributed in Laos, EDL-Gen has a quasi-monopoly on power generation and sales which are contracted through 30 year power purchase agreements (PPA’s) with EDL. These PPA’s are fixed in USD with the price of electricity sales increasing 1% per year ensuring EDL-Gen remains profitable and FX risk with the Lao Kip is minimized both for the company and investors.

Although these two companies are the stars of the Laos economy, capital markets still require forward thinking regulators to ensure growth and stability. One of my last meetings in Laos was with Saysamone Chanthachack, the Acting Secretary General of the Laos Securities Commission Office and a bright spot for the country and financial integration among CLMV countries. A highly educated and well-spoken woman, her plans are ambitious. Having categorized a list of over 500 SOE’s and created a high quality team to assist these SOE and other private companies through to listing, her vision is to have 60 companies listed by 2020. Such an initiative would see this country of 6 million people have a more robust and hopefully liquid stock market than some of its regional counterparts.

After meeting the Secretary General, our broker took me for a local meal which was one of the best I had during my time in Laos. We indulged in the local delicacies of pork laab, traditional Lao sausage, and deep fried chicken ankle which squeaks when you eat it.

Laos is arguably the ASEAN country with the largest information gap and a textbook example for why we conduct on-the-ground due diligence. I see the country continuing to liberalize its economy and further engage/integrate with its neighbors, presenting a significant long term opportunity which we look forward to being a part of.

|

|

|

| I hope you have enjoyed reading this newsletter. If you would like any further information, please get in touch with me or my colleagues. |

Sorry, comments are closed for this post.