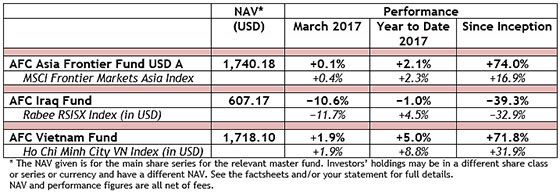

March 2017 was generally a mixed month for world markets with some markets giving back part of their gains from earlier this year, including the Dow Jones Index (−0.7%), the Nikkei 225 (−1.1%), and the Shanghai Composite Index (−0.6%). In contrast, other markets continued ahead, such as the Euro Stoxx 50 Index which rose by +5.5%, while the MSCI Emerging Market Index increased by +2.4%, the MSCI Frontier Markets Index gained +1.3% and, the MSCI Frontier Markets Asia Index advanced by +0.4%.

The AFC Asia Frontier Fund gained +0.1% compared with the MSCI Frontier Markets Asia Index which went up +0.4%. The fund is now up +74.0% since inception, which corresponds to an annualized return of +11.7% p.a.

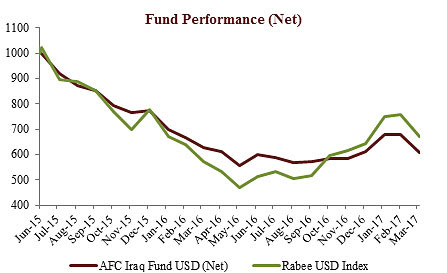

The AFC Iraq fund returned −10.6% in March and its performance year-to-date is −1.0%.

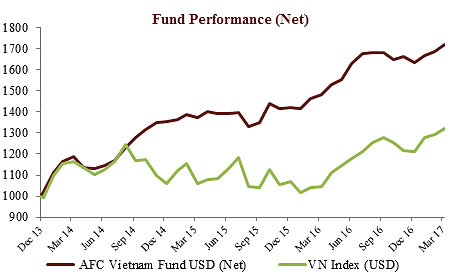

The AFC Vietnam Fund rose +1.9% in March, matching the VN-Index in USD. The fund is now up +71.8% since inception, which corresponds to an annualized return of +18.0% p.a.

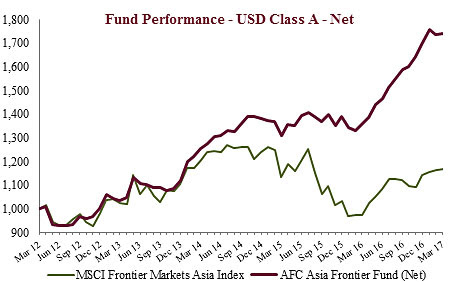

As written in our special edition newsletter last week, we have celebrated the 5-year anniversary of our AFC Asia Frontier Fund.

In its 5 years the fund has performed very well, returning +11.7% annualized in US Dollars and +12.8% in Swiss Francs. The Euro share class was launched on the 1st February 2014 and had an annualized return of +16.3% since inception. During each calendar year, the fund has had a positive return, and it has a very low annualized volatility of 9.1% and a resulting Sharpe ratio of 1.3.

The fund grew from a very low initial seed capital to USD 22.2 mln currently. We are looking forward to continued growth, both in terms of additional capital as wells as in terms of fund performance.

The general strategy of the fund has remained unchanged over these 5 years and this winning formula is rooted in the following basic principles:

- Selection of a universe of promising Asian frontier countries that show a strong and sustainable GDP growth, healthy demographic characteristics and continuing trends including urbanization and growth of the middle class

- Top-down asset allocation, favouring countries that are most promising and which carry a relatively low risk

- Invest a large proportion of the fund in the country’s blue chip stocks at low valuations with a focus on the consumer sector

- Acquire growth stocks, but only if the valuations are reasonably cheap

- Invest with a medium to long term investment horizon

- Diversify over several countries and currencies (currently 10) and a relatively large number of stocks, currently 112

- Strong focus on managing the down side risk in order to preserve the capital

On the exact date of the fund’s 5th birthday, AFC received a significant award from the CNBC Allocator’s Investors Choice Awards 2017.

The award, in the category “Emerging Long Only Equity Fund of 2016”, very timely acknowledged the investment team’s capabilities of generating outstanding performance at low volatility on markets from where many investors would shy away. The fund returned 22.5% in 2016. One reason for the strong performance is the low level of interest from international investors for investing in frontier markets Consequently, the valuations are more attractive and there are numerous promising and under researched companies, resulting in profitable investment opportunities for the fund, and resulting in a low correlation with world markets, which is currently at 0.3.

AFC’s Ahmed Tabaqchali receives the Investors Choice

Award from CNBC’s Squawk Box presenter Karen Tso

(Photo: Allocator)

On the very same day, the 30th March 2017, AFC received two additional important awards from Asia Asset Management, during their “Best of the Best Awards Dinner” in Hong Kong.

AFC received the award for “Vietnam: CIO of the year” for the efforts of Vicente Nguyen, the fund manager of the AFC Vietnam Fund. AFC also won the award in the category “Vietnam: Most Innovative Product”. The AFC Vietnam Fund returned +15.3% in 2016 and had a low annualized volatility of 9.27% and an impressive Sharpe ratio of 1.79x at the end of 2016 (since inception).

Asia Asset Management’s CEO Tan Lee Hock presents the award

for “Vietnam: CIO of the Year” to AFC’s Peter de Vries

(Photo: Asia Asset Management)

Ahmed Tabaqchali, the CIO of the AFC Iraq Fund, gave a presentation at the 2nd MENA Financial Markets Roadshow titled “Middle East & North Africa” on the prospects of investing in Iraq.

Ahmed Tabaqchali speaks at the 2nd MENA Financial Markets Roadshow

Ahmed will also be presenting at the Iraq Stock Exchange Forum which is to be held in Beirut, Lebanon on the 8th and 9th May 2017. The forum aims to highlight and develop the financial and capital markets in Iraq. The Iraq Stock Exchange is organising the conference in cooperation with Frontier Exchange, a British company with strong expertise in organising financial conferences and events for global stock exchanges.

This eventful month for AFC is the result of the dedication of AFC’s team of professionals that focus on top investment performance for the benefit of our investors. Below, please find the manager comments for the month for each of our funds, and we finish this newsletter with a travel report which this time, is featuring the AFC Vietnam Investor Tour that we held from 27thMarch to 2nd April 2017.

AFC in the Press

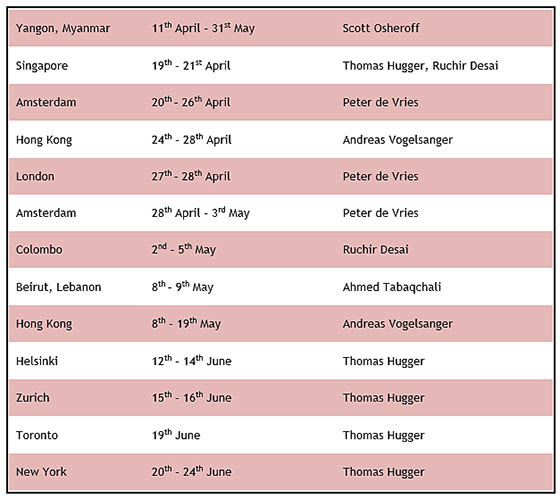

Upcoming AFC Travel

If you have an interest in meeting with our team during their travels, please contact Peter de Vries at pdv@asiafrontiercapital.com.

AFC Asia Frontier Fund – Manager Comment March 2017

AFC Asia Frontier Fund (AAFF) USD A-shares gained +0.1% in March 2017. The fund underperformed the MSCI Frontier Markets Asia Index (+0.4%) the MSCI World Index (+0.8%) and the MSCI Frontier Markets Index which was up +1.3%. The USD A shares achieved a NAV of USD 1,740.18 The performance of the AFC Asia Frontier Fund A-shares since inception, on 30th March 2012, now stands at +74.0% versus the MSCI Frontier Markets Asia Index which is up +16.9% and MSCI Frontier Index (+10.6%) during the same time period. The fund’s annualized performance since inception is +11.7% p.a. while its YTD performance stands at +2.1%. The broad diversification of the fund’s portfolio has resulted in lower risk with an annualised volatility of 9.06%, a Sharpe ratio of 1.28 and a correlation of the fund versus the MSCI World Index USD of 0.33, all based on monthly observations since inception.

The fund began its 5-year anniversary by winning the award for Emerging Long Only Equity Fund of 2016 at the Investors Choice Awards held in London on 30th March 2017.

Performance for the fund improved relative to the previous month but was dragged down by a correction in the Iraqi market which was due to profit taking given that the Iraqi market has seen a robust rally over the past six months. This correction gives us an opportunity to accumulate further positions in Iraq.

Amongst the fund’s larger markets, performance was led by Vietnam where returns were led by a real estate developer (which is up 65% year-to-date), a cement company and a consumer conglomerate in which the fund initiated a position in during the month. Vietnam’s first quarter 2017 GDP growth numbers were a tad disappointing at +5.1% given expectations of +6% growth for the whole year but this needs to be put into context as the resources sector i.e. oil & gas cut ~90 bps off of overall growth. Key drivers of growth such as manufacturing and services grew 8.3% and 6.5% respectively which is still a healthy sign. The cyclical upturn in Vietnam remains ongoing and this was backed by positive FDI commitments of USD 7.7 bln in the first quarter of 2017, a growth of 78% YoY. We continue to be positive on select real estate players, infrastructure, material and consumer discretionary related companies.

Pakistan also helped with performance. The fund’s Pakistani holdings outperformed the KSE100 Index, which declined by 0.8% due to worries over the impending Supreme Court decision in the Panama Papers case against the Prime Minster. However, worries/rumours of the judgement asking the Prime Minister to step down may be overdone as the current civilian government has so far built a reasonable balance with the military over critical policies related to security.

The fund initiated a new position in Sri Lanka – a conglomerate with interests in transportation logistics, consumer staples and property. Valuations for this company are at 7 to 8 year lows in terms of P/E and P/B ratios while earning expectations appear to be fairly stable. Valuations in general in Sri Lanka are starting to look very attractive.

The best performing indexes in the AAFF universe in March were Cambodia (+5.4%), Laos (+3.5%) and Bangladesh (+1.9%). The poorest performing markets were Iraq (−11.7%) and Mongolia (−3.3%). The top-performing portfolio stocks this month were an oil exploration company from Papua New Guinea (+61.8%), an investment company from Myanmar (+40.0%), a Mongolian gold exploration company (+33.3%) and a Mongolian duty free operator (+25.2%).

In March, we added to existing positions in Bangladesh, Iraq, Laos, Mongolia, Pakistan and Vietnam and partially sold three Mongolian holdings while exiting completely a Pakistani textile company. We newly added a Pakistani paint company, a Bangladeshi mobile phone operator, a Sri Lankan conglomerate and two new holdings in Vietnam: a conglomerate focusing on consumer goods and a petroleum transportation company.

As of 31st March 2017, the portfolio was invested in 112 companies, 1 fund and held 4.4% in cash. The two biggest stock positions were a pharmaceutical company in Bangladesh (8.1%) and a Pakistani pharmaceutical company (4.9%). The countries with the largest asset allocation include Vietnam (26.6%), Pakistan (26.1%), and Bangladesh (17.5%). The sectors with the largest allocation of assets are consumer goods (29.7%) and healthcare (18.6%). The estimated weighted average trailing portfolio P/E ratio (only companies with profit) was 20.05x, the estimated weighted average P/B ratio was 3.41x and the estimated portfolio dividend yield was 3.08%.

For more information about Asia Frontier Capital’s Asia Frontier Fund please click the following links:

Factsheet AFC Asia Frontier Fund – March 2017

Factsheet AFC Asia Frontier Fund (non-US) – March 2017

AFC Asia Frontier Fund Presentation (English)

AFC Asia Frontier Fund Presentation (Chinese-Traditional)

AFC Asia Frontier Fund Presentation (Chinese-Simplified)

AFC Iraq Fund – Manager Comment March 2017

AFC Iraq Fund Class D shares returned −10.6% in March as the market began a process of correction and profit taking as part of a consolation after the blistering upside momentum over the last few months.

The RSISUSD Index is finally undergoing a long-anticipated pull-back, down −11.7% for the month. As welcome as the pull-back is, it is modest in the context of the +50% uninterrupted run from September 2016 to February 2017. The most likely outlook is still for an extended consolidation over the next couple of months. However, it is not clear if the current pull-back will continue for a few weeks longer or snap back, mainly, because the recent correction has been on very low volume.

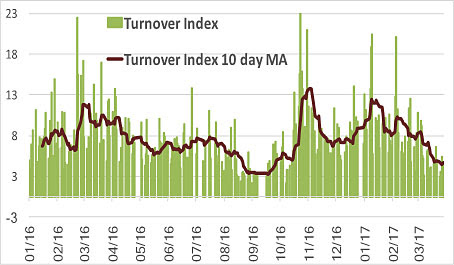

Prices have mostly drifted lower on extremely low volume with the average daily turnover approaching the multi-year lows of last summer (see chart below), which preceded the market’s explosive run from September 2016. Worthy of note and confirming earlier bullish sentiment, declines in individual stock prices would halt with the emergence of buying interest, or meaningful buying interest would emerge once prices dropped back to year end levels. Similar developments took place last summer which were in sharp contrast to the situation during the sustained declines of the first half of last year.

Turnover index on the Iraq Stock Exchange (ISX) (green)

vs 10-day moving average turnover (red)

(Source: Iraq Stock Exchange (ISX), AFC)

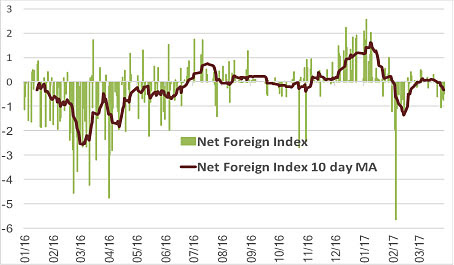

While foreigners have been net sellers in the local equity market for the second month in a row (see chart below), overall foreign interest in Iraq continues to go through a transformational change in the eyes of global institutional investors, as is clear from the narrowing of the spread between the yields of Iraq’s Eurobond and the 10 year US Bond, or in other words a reduction of Iraq’s sovereign risk premium (see second chart below).

Net Foreign Index on the Iraq Stock Exchange (ISX) (green)

vs its 10-day moving average (red)

(Source: Iraq Stock Exchange (ISX), AFC)

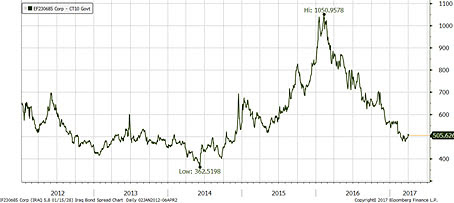

Yield spread between Iraq’s Euro bond and 10 year US Bond

(Source: Bloomberg)

The chart clearly shows that the risk-premium reached its maximum in early 2016 and has returned to 2012-2014 levels during which Iraq was the focus of high foreign investment interest. However, what it does not show, is that the narrowing of the spread between November 2016 and now was a combination of a rise of the 10-year US bond yield from around 1.8% to the current 2.3% and a decline in the yield of Iraq’s bond from around 9% to the current 7.3%. In other words, Iraq’s sovereign risk premium continued to narrow even in an environment of rising yields and especially currently as the country is trying to raise a second USD 1 bln Eurodollar bond (not guaranteed by the US government unlike the January USD 1 bln Eurodollar bond issuance which was priced at a 2.1% YTM). It seems logical to conclude that this implies favourable interest in Iraq and that it would likely be followed by FDI and eventually by equity inflows. This interest will grow with the re-rating of Iraq’s credit as evidenced by Fitch’s outlook upgrade from “Negative” to “Stable”.

Much was said in last year’s updates about the delayed correlation between Oil prices, Iraq’s Euro bond and the equity market with the first two rallying for much of the year while the equity market was declining and belatedly reasserting the correlation later in the year. As such it’s fitting to consider the action of both during the period 2012 to the present time to get some indication of the potential future direction of the equity market. The chart below shows the bond to be leading by a few months and that it has retraced about 80% of its decline from the 2014 peak to the 2016 lows vs. the less than 30% retracement by the equity market from its 2016 lows. However, considering that the two are very different products with crucially different characteristics the comparison is only relevant as an indication of the direction of the potential recovery of the equity markets.

Iraq’s Euro Bond (red), 200 day moving average (green)

(Source: Bloomberg, Börse Frankfurt, AFC)

Rabee Securities’ RSISUSD Index (red), 200 day moving average (green)

(Source: Iraq Stock Exchange (ISX), Rabee Securities, AFC)

As the month demonstrates, the improvement in liquidity is still in its early phases, with overall liquidity in the economy still scarce. And, given that the known risks of the last two years are still present, the recovery will likely be in fits and starts and the opportunity continues to be to acquire attractive assets that have yet to discount a sustainable economic recovery.

The Mosul offensive continues to progress with the increasing reclaiming of neighbourhoods in the western side of the city, but progress is slowing as the fighting is grinding from street by street to house by house. Meanwhile, increased US support and involvement was further affirmed during the recent visit to the US by Iraq’s PM.

The US strike against Syria in response to the chemical weapons atrocities committed against the innocent civilians in the rebel-held town of Khan Sheikhoun in Syria will likely complicate the resolution of conflict in the region. The first complication would be the US-Russian convergence on the specifics for the resolution of the Syrian conflict and in particular the battle for Raqqa. However, apart from the heated verbal exchanges, the substance of the relationship will not likely change much given the limited nature of the attack with zero direct impact on the Russian military and, so far, limited real change on the ground by the Russians. Specifically, for Iraq it will reinforce the recent messages of increased US support for the war against ISIS. The most important thing to watch for is the nature of the solution for post conflict and the role of regional/international players given that the Trump administration has reaffirmed, at least for now, the historic US involvement in the region as opposed to the isolationist stance implied from the presidential campaign.

As of 31st March 2017, the AFC Iraq Fund was invested in 14 names and held 1.2% in cash. The fund invests in both local and foreign listed companies that have the majority of their business activities in Iraq, the countries with the largest asset allocation were Iraq (98.0%), Norway (1.7%), and the UK (0.3%). The sectors with the largest allocation of assets were financials (57.1%) and consumer staples (22.4%). The estimated trailing median portfolio P/E ratio was 13.91, the estimated trailing weighted average P/B ratio was 1.07x and the estimated portfolio dividend yield was 2.32%.

For more information about Asia Frontier Capital’s Iraq Fund, please click the following links:

Factsheet AFC Iraq Fund – March 2017

Factsheet AFC Iraq Fund (non-US) – March 2017

AFC Iraq Fund Presentation

AFC Vietnam Fund – Manager Comment March 2017

The AFC Vietnam Fund returned +1.9% in March with an NAV of USD 1,718.10, a new all-time high, bringing the net return since inception to +71.8%. This represents an annualized return of +17.6% p.a. The March performance of the Ho Chi Minh City VN Index in USD was also +1.9% while the Hanoi VH Index increased by +4.8% (in USD terms). Since inception, the AFC Vietnam Fund has outperformed the VN and VH Indices by +39.9% and +48.3% respectively (in USD terms). The broad diversification of the fund’s portfolio resulted in a low annualized volatility of 9.01%, a high Sharpe ratio of 1.98 and a low correlation of the fund versus the MSCI World Index USD of 0.30, all based on monthly observations since inception.

The market behaviour seemed quite lacklustre in March. The broader market corrected slightly after gaining earlier this year while the performance of our holdings was mixed. Meanwhile, the main index in HCMC was up +1.6% for the month. The index in Hanoi surged +4.6% with its biggest constituents rallying.

Vietnam will most likely not be much affected by “Trumponomics”

If we consider how “Trumponomics” could affect Asia one can probably expect that the US will take a tougher stance mainly against China, but what about the other Asian countries and what does a “tougher stance” mean?

We think Trump will take certain measures to make life difficult especially for US companies producing abroad and then exporting these goods to the US, such as Ford, Carrier and Apple. He will probably target countries with which the US has a high trade deficit and certain sectors or key product groups.

Let’s first take a look at the cumulative foreign direct investments (FDI) into Vietnam.

(Source: VietCapital)

(Source: VietCapital)

As you can see from the numbers above, the US only accounted for 3.5% of total FDI into Vietnam. But how relevant are Vietnamese exports to the US and how big is the trade deficit between the US and Vietnam?

(Source: US Census Bureau / Bloomberg)

Again, Vietnam accounts for only 1.9% of total US imports while the trade deficit is nowhere close to the numbers of either China or Mexico. But for Vietnam, the US is an important market.

(Source: GSO)

It is actually Vietnam’s largest export market with 21.9% of total exports and growing fast as shown below:

(Source: Customs Office)

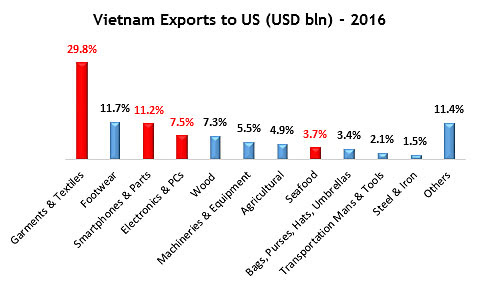

But what exactly is Vietnam exporting to the US?

(Source: Customs Office)

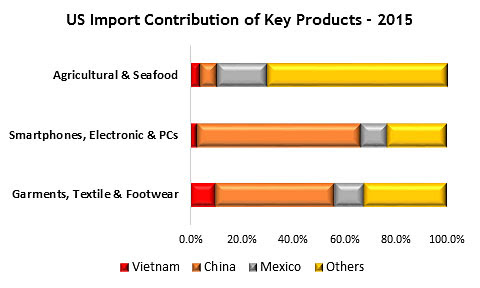

It is expected that the Trump administration will be focusing mainly on 3 specific product groups, such as – smartphones, electronic & PCs – garments, textile & footwear – agricultural & seafood.

(Source: US Census)

As you can see from the table above, Vietnam’s contribution to these 3 key product groups is still relatively small. We were pleasantly surprised when we saw an announcement by a Chinese polyester and fiber manufacturer to open a plant in Tay Ninh, Vietnam in February, making China the second largest FDI investor after Singapore in February! Maybe Vietnam will become a net beneficiary of the US-China tensions after all.

(Source: US Census Bureau)

We do think that mobile phones could be targeted by the Trump administration, but this will be a much bigger issue for China than Vietnam, since Apple is a US company producing in China and exporting from there to the US. In Vietnam, we have of course Samsung producing almost all their mobile phones in Vietnam, but given that Samsung is a Korean company and that their market share in the US is only 25.5%, compared to Apple with around 62%, Vietnam will probably not be affected significantly.

Irrespective of the outcome of “Trumponomics”, our portfolio is very well positioned. Only 4 out of a total of around 80 companies are in one of these three sectors, representing only about 5% of our total portfolio. Those 4 companies are currently trading between 5.8x and 10x earnings and offer an average dividend yield of 11%. We are therefore not worried about whatever outcome from the impending “Trumponomics” will be.

Economy

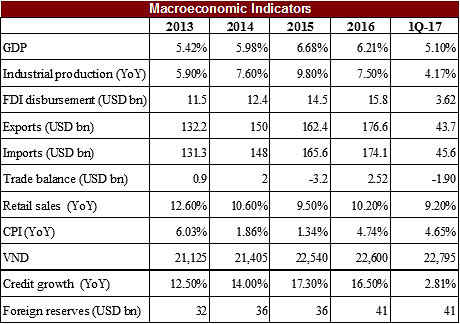

(Source: AFC research, SSI, GSO, SBV, VCB)

The Vietnam economy realized GDP growth of 5.1% in the first quarter of 2017, a bit lower compared to same period last year. Services continued to lead the growth with a 2.65% contribution, followed by the industrial and construction sectors with 1.46%, the agricultural sector with 0.24%, and tax with 0.75%. GDP growth in 1Q 2017 is lower than 1Q 2015 and 1Q 2016, but higher than 1Q 2014. In 1Q 2017, industrial production growth fell YoY to 4.17% from 7.16% in 1Q 2016. This was the smallest expansion in 5 years.

An important characteristic of the Vietnamese economy is FDI. New FDI registrations and additions increased to USD 7.71 bln, a surge of 77.6% YoY. Particularly Korean business conglomerates, such as Samsung Display of the Samsung Group, registered to invest an additional USD 2.5 bln in Bac Ninh Province. South Korea continues to be the largest FDI investor in Vietnam with USD 3.74 bln YTD, contributing 48.5% of the total. Accumulated FDI disbursements in March reached USD 3.62 bln, a gain of 3.6% YoY.

Total export revenue of Vietnam increased to USD 43.7 bln, increasing by 12.8%. Imports also increased, reaching USD 45.6 bln, (+22.4% YoY). In the first quarter of 2017, Vietnam recorded a trade deficit of USD 1.9 bln, equivalent to 2.1% of total trade value.

The CPI was 4.65% higher YoY, with healthcare and education being the main contributors to this as their costs surged by 35.9% and 10.2% respectively.

Other developments

With more than half of the world’s population currently living in cities it is vital that cities embrace, support and nurture technological changes in order to compete in today’s world. The recently published JLL 2017 City Momentum Index from Jones Lang LaSalle shows some astonishing results. Although the most dynamic cities are spread throughout the world, more than half of the top 30 in the 2017 ranking are in the Asia-Pacific region. Ho Chi Minh City was in 2nd position with Hanoi in 8th out of the top 10!

At the end of March 2017, the fund’s largest positions were: Agriculture Bank Insurance JSC (3.1%) – an insurance company, Sam Cuong Material Electrical and Telecom Corp (2.4%) – a manufacturer of electrical and telecom equipment, Hatay Pharmaceutical JSC (2.1%) – a pharmaceutical company, Pharmedic Pharmaceutical Medical JSC (1.9%) – another pharmaceutical company, and Bibica Corp (1.9%) – a packaged foods manufacturer.

The portfolio was invested in 81 names and held 5.6% in cash. The sectors with the largest allocation of assets were consumer goods (31.5%) and industrials (25.2%). The fund’s estimated weighted average trailing P/E ratio was 9.88x, the estimated weighted average P/B ratio was 1.61x and the estimated portfolio dividend yield was 6.88%.

For more information about Asia Frontier Capital’s Vietnam Fund please click the following links:

Factsheet AFC Vietnam Fund – March 2017

AFC Vietnam Fund Presentation

AFC Travel Report – Investor Tour in Vietnam

This month we publish a summary of our Vietnam Investor Tour to which a number of investors and friends joined us to get a better idea of the investment potential in Vietnam. Scott Osheroff, Analyst at Asia Frontier Capital, compiled the below report. The photos in this article are all by AFC.

Last month Asia Frontier Capital hosted a group of investors to what is arguably the most important emerging economic power in ASEAN: Vietnam. Spending nine days traversing the country from Hanoi and Hai Phong in the north to Saigon, Can Tho and Phu Quoc in the south, we immersed ourselves in the manufacturing, services and tourism sectors to better understand the dynamics of this thriving economy.

Having hosted a similar tour two years ago, those who attended again were astonished at how the country is transforming, becoming ever more developed in terms of infrastructure and real estate, as well as seeing a continuing influx of factories from China, South Korea and elsewhere. At the moment, Vietnam is in an economic “sweet spot” and we continue to be enticed by its prospects.

Our tour began with a trip to Ninh Binh, an emerging tourist destination in the north of Vietnam. Most tourists visit either Ha Long Bay or Sapa, but Ninh Binh, perhaps best referred to as Ha Long Bay on a river, rather than the sea, is likely to see a significant influx of foreign tourists going forward. With a similar topography to Ha Long Bay, we visited a secluded pagoda among the sharp, jagged hills. This was followed by a boat tour of the river and several pitch-black grottos which we navigated through with flash lights, ensuring not to bump our heads. In Ninh Binh it was interesting to see the majority of the tourists were either Vietnamese or Chinese, something we expect to soon change.

Landscape in Ninh Binh

My captain on the river in Ninh Binh: Foot power!

Up until last year tourism was largely a nascent industry in Vietnam and something many domestic travel agents I have spoken with were worried about as there was too much competition among a shallow pool of tourists. However, late last year Vietnam lifted short term visa requirements for several European countries allowing 15-day visa free travel, and also allowed Americans to purchase 1-year multiple entry visas. This, combined with a rapidly growing number of Chinese tourists, saw arrivals in the first two months of 2017 reach 2.2mln (+33% YoY). The Vietnamese government is very focused on promoting tourism to Vietnam (which currently represents ~9% of GDP) and is aiming to realize 11.5mln arrivals in 2017.

The next two days were spent visiting companies in Hanoi and Hai Phong, Vietnam’s third largest city. In Hanoi we visited the largest brewery in North Vietnam, Hanoi Beer Corporation, a pharmaceutical manufacturer, a plastic bag producer focused of food and medical grade products which it is exporting to Japan and the EU, and the largest privately operated port in Vietnam, which is located in Hai Phong.

Bridge under construction over the Hai Phong river

Hai Phong River Port

In order to learn about the opportunities and challenges facing Vietnam’s integration with the region and world, as well as how it is procuring products for the domestic market, we visited the Gemadept Port operation in Hai Phong. Having several ports along the river, our group accompanied management on a boat tour of the company’s operational ports as well as a new one under development. The Hai Phong river ports have a combined capacity of ~5mln TEU (twenty foot containers) with ~70% of volume for imported goods and 30% of volume for exported/finished products. This compares with the ports in the south of Vietnam which have a more balanced ~50/50 split between exports and imports. With China being Vietnam’s largest trading partner and Vietnam having a trade deficit with China it would make sense for there to be more imports in the north compared to the south of Vietnam.

Nonetheless, in the north of the country there is an emerging tech manufacturing sector where higher value products are being produced and port import/export ratios become less important as mainly raw materials and items for domestic consumption are imported while high value items are increasingly exported. Samsung is a significant driver of this as this South Korean conglomerate is the biggest manufacturer of electronics and also the largest foreign investor in Vietnam, having already invested or planned to invest USD 6.5bln.

From Hai Phong we flew south to Saigon where we attended a day of boardroom meetings hearing from the largest fertilizer and dairy companies in the country. We also heard from a ferry operator whose main routes are from the southern cities of Ha Tien and Rach Gia to the rapidly growing tourism destination of Phu Quoc, an island off the southern tip of Vietnam which used to belong to Cambodia, and the Nam Du islands. The ferry operator is realizing significant growth and is looking for additional routes to add as demand continues to accelerate, mainly among domestic Vietnamese travellers.

The next day we drove south from Saigon where we visited Thien Long Group (TLG), the largest pen and office supply manufacturer in Vietnam. TLG manufacturers its own brands of pens and markers, but also operates on an OEM basis. Seeking to become a regional competitor, ~20% of TLG’s revenues currently come from exports with their main markets being Japan and the USA, followed by Cambodia and Laos. TLG has seen its business grow by nearly 4 times since 2012 and we see continued growth potential in the company as it both grows its market share and begins to automate its factory, driving an increase in margins.

Our investor tour group at HABECO (Hanoi Beer Corporation)

(Before visiting the tasting room)

Visit to Thien Long Group (TLG)

Our visit to TLG was followed by lunch at a fish processing facility which is capable of processing 250,000 kg of Pangasius fish per day. They are an export focused company with their main markets being the USA and Europe where they supply some of the most well-known supermarket retailers. Complying with international standards, the factory was both exceedingly clean and efficient as several hundred workers scaled, filleted, froze and packaged the fish filets for export.

That evening we stayed in the city of Can Tho where we enjoyed a relaxing dinner cruise on the Mekong river delta, followed the next morning by a tour of the famous Cai Rang floating market.

Dinner cruise on the Mekong River Delta near Can Tho

Visiting the Cai Rang Floating Market

The following day we flew from Saigon to Phu Quoc Island (which is nearly the same size of Phuket Island in Thailand). Phu Quoc in recent years has seen very large investments in road and power infrastructure, as well as hotel developments. Branded as a tourist zone where foreign visitors do not need visas for short visits, Phu Quoc has the potential to become the Phuket or Hawaii of Vietnam, but in development terms it is perhaps where Phuket and Hawaii were twenty to thirty years ago — still tranquil and full of opportunity as visitor numbers accelerate. Vin Group, a locally listed company, has already taken advantage of Phu Quoc’s rapidly changing landscape with the opening of the VinPearl resort which boasts 671 rooms, a golf course, fun park and a soon-to-be completed casino (the first casino in Vietnam where Vietnamese will be allowed to gamble).

A beautiful beach on Phu Quoc Island

As our Vietnam tour came to a close, Phu Quoc was an ideal venue to reminisce about our trip and reflect on the economic potential on offer in Vietnam. We remain highly upbeat about the country’s macro-economic potential and we see it as one of the most promising frontier economies for investment in the medium and long term that will benefit our investors in both the AFC Vietnam Fund and the regional AFC Asia Frontier Fund for years to come.

Sorry, comments are closed for this post.